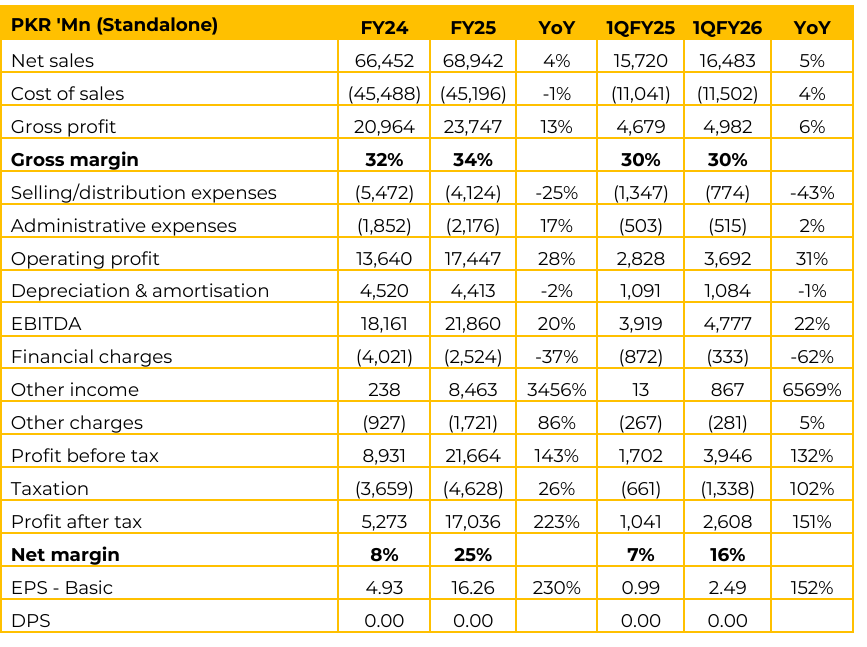

MLCF has reported standalone earnings per share of PKR 16.46 in FY25 (FY24: PKR 4.93). Furthermore, in 1QFY26 the company reported EPS of PKR 2.49 (1QFY25: PKR 0.99). Management noted that the industry has seen a period of contraction from 2021 onwards.

However, the first quarter of the year has started with a very positive momentum. Cement prices recently increased by about PKR 20 per bag, driven primarily by a 6% royalty imposition in Punjab. The case regarding this royalty is pending at the Supreme Court. MLCF benefits from branding, resulting in high retention prices, selling its cement at a premium of 5 rupees to 18 rupees. MLCF is the largest single-plant facility in Pakistan (8 million tons capacity at one site), providing a huge advantage in overhead absorption. MLCF also controls about 90% of Pakistan’s white cement market. The energy mix is highly diversified, contributing to one of the lowest costs in the industry.

Current fuel mix entails Pet Coke (60%), Biomass (35%) and Imported Coal (5%). Total power cost is 5.6 cents (less than 16 rupees per unit). Coal fired power plant contributed 60%, Waste Heat Recovery contributed 26%, Solar remains 8% (planning expansion, but limited by the continuous operation of the coal-fired plant; future solar power will be primarily used for grinding activity), while the remaining 6% was utilized from National Grid. In 1QFY26, gross margins declined to 30% (4QFY25: 39%) primarily due to the annual shutdown of two lines, causing under absorption of fixed overhead costs, combined with slightly declining prices.

Management expects margins to normalize to approximately 35% going forward. Management does not anticipate that north-based players will begin exporting through the sea; the South will continue to lead exports. Current imported coal prices are low due to the bearish international market, a trend expected to continue in the short term, offsetting issues with the still-closed Afghanistan border.

The industry has seen a period of contraction from 2021 onwards. However, the first quarter of the year has started with a very positive momentum, projecting an industry growth of almost 18.8%. Management’s personal view is a double-digit growth, likely between 10% and 15%. Conservative projection scenarios for 2026 sales volume are 41 million metric tons (10% growth) or 48 million metric tons (13% growth).

The industry installed capacity is 80 million metric tons. Local sales consumption would equate to 50% to 53% utilization based on the 10-13% growth scenarios. Demand has historically come primarily from the private sector. Affordability issues that arose during previous devaluations are easing, as prices have covered inflation while people’s incomes have increased, reducing the negative impact.

Agritech Limited (AGL) is acquired jointly with Fauji Fertilizer Company (FFC). MLCF holds a 40% share. FFC provides access to the largest sales/marketing network and best engineering/production management team. AGL is undergoing debt restructuring to reverse large unpaid financial charges and reprofile debt (face value debt currently PKR 18 billion). The company is already making slight operational profits, with overall profitability expected to increase significantly. Novacare Hospital is a new hospital project in Islamabad. MLCF holds virtually 100% ownership.

Total cost is USD 100 million. Initial capacity is 250 beds, expandable to 450. Expected to be fully operational by the end of 2026. Civil work is 70% to 80% complete. Management projects achieving cash positivity within 24 to 30 months after launch. Maple Leaf Power Limited (MLPL) is a 100% wholly owned subsidiary of MLCF. Provides a tax arbitrage as its profits are exempt from taxation under statute, but its numbers are consolidated into the cement figures.

These zero taxations save the company an estimated PKR 400 to 500 million every year. MLPL typically generates PKR 1.2 to 1.5 billion annually. Recently received a court judgment confirming zero taxation on dividend distribution from a 100% owned subsidiary, leading to a one-time recognition of 4-5 years of accumulated cash totaling 6 billion (eliminating upon consolidation).

If the current legal stance prevails (zero taxation for 100% owned subsidiaries on dividend distribution), management confirmed that on a standalone basis, analysts “will see continuously the dividends coming”.

However, management emphasized that when the results of the 100% subsidiary are consolidated with MLCF, all these dividends and intercorporate profitability are eliminated. Going forward, the company is seeking new viable ventures for investment and does not seem in a hurry to do so and also mentioned that due to the prevailing high taxation environment there are not many avenues to invest in.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.