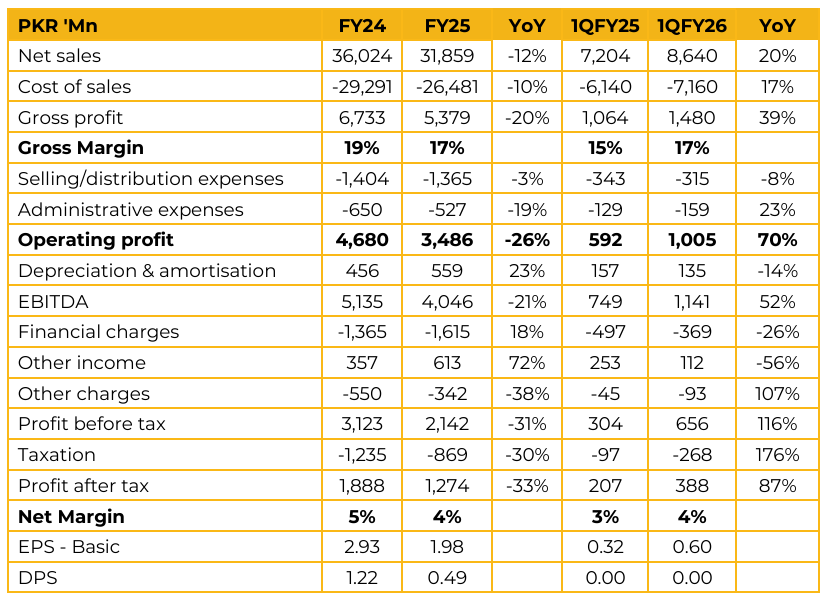

Fast Cables Limited (FCL) reported earnings per share of PKR 1.98 for FY25, compared to PKR 2.93 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 0.60, compared to earnings per share of PKR 0.32 in the same period last year (SPLY).

The company highlighted that it produces the widest portfolio of cables and conductors in the country, with over ten product categories and approximately 6,000 SKUs. Its product range includes transmission line cables, conductors, control and instrumentation wires, underground power cables, and overhead conductors.

Management also discussed the company’s growing focus on the lighting segment, which now includes home, commercial, and infrastructure-grade street lighting solutions. Management highlighted that as part of its five-year plan, the company aims for the lighting division to contribute 10–15% of overall revenues. The company emphasis is on product excellence and adherence to global technical standards. Management reiterated that FCL was the first Pakistani cable manufacturer to receive gold-level KEMA certification from the renowned high-voltage laboratory in Holland. Further, FCL is the first Pakistani cable producer to obtain certification from a third-party British standards organization, reflecting full compliance with best manufacturing practices. This accreditation has expanded the company’s eligibility to serve regional and global projects, including approval to supply cables to the UAE government’s transmission network.

The company operates the first ISO 17025-certified laboratory in Pakistan’s cable and wire industry, placing its testing capabilities on par with international laboratories. This gives FCL a distinct competitive advantage, particularly in export markets where compliance and reliability are critical. Within Pakistan, FCL maintains a nationwide branch and distribution network. Internationally, it has established a commercial presence in Saudi Arabia, the UAE, and the United States through staff and strategic partners. Despite its technical strengths and diversified operations, FCL experienced a challenging operating environment during the year.

The company faced inflationary cost pressures, rising energy tariffs, and intensifying competition across major segments. These factors collectively pressured pricing and margins.

Moreover, procurement from key government and institutional customers declined significantly, with orders from utilities and state linked entities falling 36% YoY. Management attributed this decline to reduced government budget allocations for DISCO modernization and infrastructure projects. Looking forward, FCL expects the operating environment to improve meaningfully from 2026 onward.

The company believes it is optimally positioned to capture both domestic and international opportunities as infrastructure spending resumes, private sector demand strengthens, and export channels deepen. Although industry margins are expected to stay competitive, the company’s strategic focus remains on expanding export volumes, and achieving consistent double digit volumetric growth over the medium to long term.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.