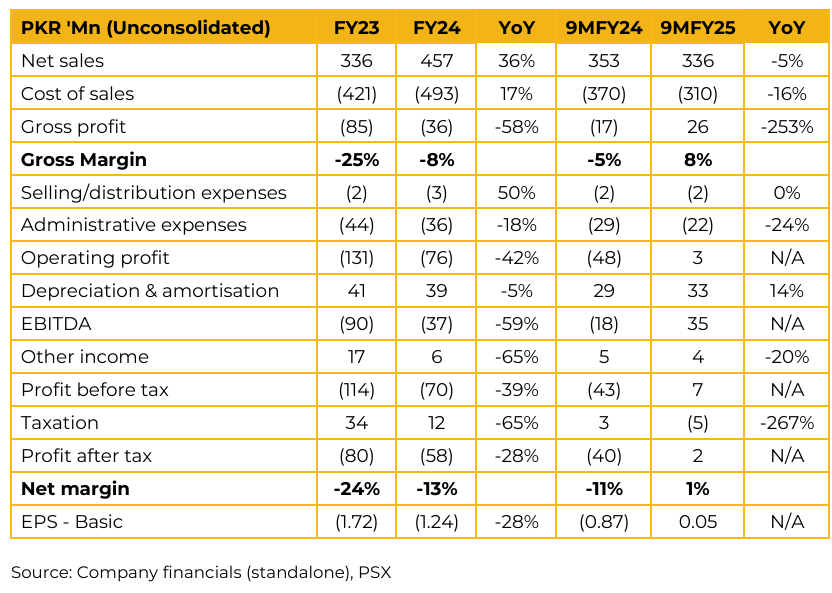

The company posted a profit after tax of PKR 2 million (EPS: 0.05) in 9MFY25 as compared to loss of PKR 40 million (LPS: 0.87) in SPLY. Management highlighted that over the last two years, more than a hundred textile mills have shut down, but ASHT has managed to survive, largely due to its near-zero financial leverage and ability to adapt its business model.

The CEO acknowledged that FY23 and FY24 had been particularly difficult, with a drastic decline in gross profits as demand for textiles in Pakistan collapsed and government policies allowed aggressive imports from China. However, management noted that customer demand has shown consistency over the last six to eight months, which provides a basis for cautious optimism heading into FY25. While prices have not improved sufficiently to generate meaningful profitability in the near term, the company expects a more visible and significant recovery by FY26. The primary focus for the current year is to stabilize operations and move “out of the red,” though no specific margin guidance was provided.

Energy costs were highlighted as a critical challenge for the industry, with both electricity and gas prices adding significant pressure and creating a multiplier effect through supplier price increases. ASHT is in the final stages of installing an 820 KW solar project.

Once fully operational, 33% of the power will be solar generated and the rest will be covered from grid. The CEO elaborated that ASHT’s shift to a conversion-based, value addition model has proven highly effective. Rather than sourcing yarn themselves, the company now primarily processes customer supplied yarn into fabric. This structure insulates ASHT from raw material price volatility, particularly cotton, which has been impacted by recent floods. Going forward, management stressed that the company’s operations will not be negatively affected by disruptions in the cotton crop, and, in fact, potential market shortages could present opportunities to capitalize on abnormal market conditions, given its low-cost structure.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.