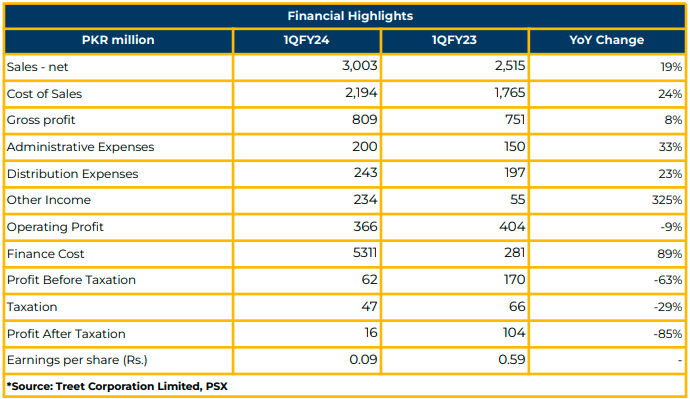

In 1QFY24, Treet Corporation Limited (TREET) reported a net income of PKR 15.74 million (EPS: PKR 0.09), a decline from the net income of PKR 103.92 million (EPS: PKR 0.59) in the same period last year.

The company achieved a significant revenue increase, reaching PKR 3.00 billion in 1QFY24, marking a substantial 19% YoY growth from the PKR 2.52 billion reported in the corresponding period last year.

Cost of sales rose by 24% YoY to PKR 2.19 billion in 1QFY24. Administrative expenses and distribution expenses increased by 33% YoY and 23% YoY to PKR 200.50 million and PKR 242.64 million, respectively, in 1QFY24. The total capacity was reported at 2.2 billion.

The finance cost of the company increased by 89% YoY to PKR 530.83 million in 1QFY24 from PKR 280.80 million in SPLY. Gross profit recorded a substantial increase of 8% YoY, reaching PKR 809.29 million in 1QFY24.

In FY23, Treet Corporation Limited (TCL) experienced a marginal decrease in total sales, reaching 1.7 billion as compared to 1.72 billion in SPLY. Local and export sales comprised 62% and 38% of the total revenue in FY23.

The net revenue of TCL increased by 37% YoY to PKR 10.17 billion as compared to PKR 7.42 billion in SPLY. Gross profit increased by 45% YoY to PKR 3.26 billion during the same period. Profit after tax decreased by 84% YoY to 134 million in FY23 from PKR 862 million in

FY22. In FY23, finance cost increased by 106% YoY to PKR 1.49 billion as compared to PKR 724 million in SPLY.

The revenue from the stainless steel, Carbon Steel, and Razors segments in FY23 was recorded at PKR 2.86 billion (28%), PKR 1.81 billion (18%), and PKR 5.59 million (54%), respectively. Stainless Steel and Carbon Steel witnessed a drop in volumes to 627 million (691 million in FY22) and 704 million (722 million in FY22) while razor sales increased to 367 million (303 million in FY22).

The revenue of Treet Battery Limited was reported at PKR 8.25 billion in FY23 as compared to PKR 4.88 billion in SPLY. Finance cost of TBL increased by 75% YoY to PKR 832 million during the period under review.

The battery plant of TREET spans over an area of 40 acres, with an annual capacity of 1 million batteries at 70% capacity.

The revenue breakup of Treet Battery Limited is as follows: maintenance-free (PKR 4.51 billion), deep cycle (PKR 2.94 billion), and heavy automotive (PKR 804 million) in FY23. TREET enjoys 80% market shares of blades and 60% of razors in Pakistan. First Treet Manufacturing Modaraba is divided into corrugation and soaps divisions. The corrugation annual capacity is 2,700 tons, ranking 5th in the market for box board plants with 70% market sharein the lube segment.

The revenue of FTMM stood at PKR 3.92 billion, a 40% increase YoY, with PKR 2.9 billion from corrugation and PKR 988 million from the soap segment in FY23. The gross profit of FTMM increased by 134% YoY to PKR 303 million in FY23 as compared to PKR 130 million in SPLY.

The installed capacity of corrugation and soaps was given at 30,000 tons and 5,000 tons, respectively, by the management.

In Renacon Pharma, TREET registered a revenue of PKR 1.07 billion in FY23, 49% YoY higher than PKR 715 million in SPLY. Gross profit also increased by 88% YoY to PKR 223 million as compared to PKR 118 million in FY22.

The expansion of this business is expected to be complete in a couple of months. The Company will start production thereafter, subject to regulatory approvals from DRAP. The Company plans to export pharma products in the next two years.

In FY23, the revenue of Treet Group stood at PKR 23.35 billion, a 48% YoY increase from PKR 15.79 billion in SPLY. Gross profit increased by 88% YoY to PKR 5.13 billion in FY23 against PKR 2.67 billion in SPLY.

The Company uses local LEDs for batteries on thirty days’ credit. The share of after-market sales is around 98%. The Company installed a solar power plant of 368Kw and plans to install another solar plant of 530Kw, which is assumed to save PKR 15 million annually. The OEM sales comprise 3% of total sales.

Moreover, the focus of the Company is on margin-driven SKUs rather than volumetric ones. The listing of the Battery business on PSX is expected in a couple of weeks in December. For the battery division, Treet expects exports to Russia along with exploring MENA market, especially KSA.

Regarding dividends, the management shared that debt repayment and expansion are the foremost priorities of the Company.

Going forward, the management plans to start a new shaving foam line and twin rubberize handle razor this year. Reprofiling short-term debt into long-term debt and raising capital (PKR 2.5 billion) through right shares, expected to be completed by January 2024, will be allocated to debt repayment (PKR 1.9 billion) and the remaining amount (PKR 500 million) will be earmarked for planned expansion.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.