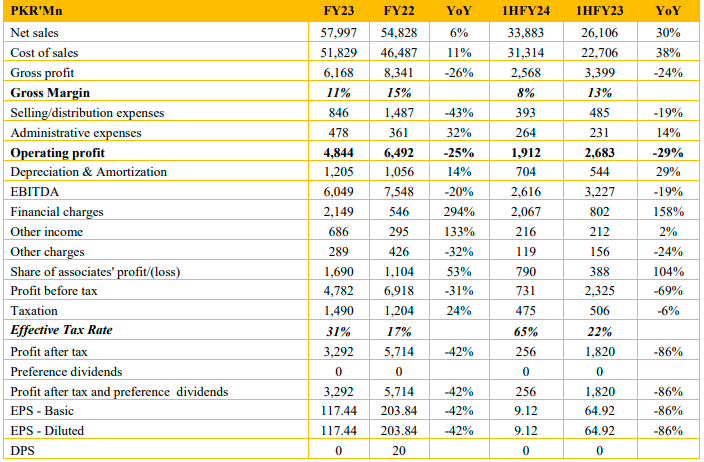

Gadoon Textile Mills Limited saw an increase in revenue to PKR 33.9 Bn in 1HFY24 up 30% from PKR 26.1 Bn in 1HFY23. Meanwhile, cost of sales surged 38% from PKR 22.7 Bn in 1HFY23 to PKR 31.3 Bn in 1HFY24. Gross margin for 1HFY24 fell to 8% from 13% in 1HFY23. As a result, gross profit fell to PKR 2.6 Bn in 1HFY24 down 24% from PKR 3.4 Bn in 1HFY23.

The company reported a decline of 29% in operating profit from PKR 2.7 Bn in 1HFY23 to PKR 1.9 Bn in 1HFY24.

Gadoon Textile Mills Limited witnessed a surge in finance costs in 1HFY24 to PKR 2.1 Bn up 158% from PKR 0.8 Bn in SPLY. This was driven primarily by the hike in the policy rate by SBP to 22%.

GADT posted a profit after tax of PKR 0.26 Bn in 1HFY24 reflecting a drop of 86% when compared to PKR 1.8 Bn in 1HFY23.

The company’s dairy segment was set up as a pilot project and as such currently is operating at breakeven levels.

BMR for the company had been deferred in the recent past but going forward it expects to resume at the necessary levels.

Gadoon Textile Mills has also been impacted by rising geopolitical tensions in the Middle East and as a result has seen lead times from Europe rise by about 10-12 days and for the US about 20 days.

The company is confident about its current inventory levels however is wary of a possible rise in shipping costs as well as any shortages in ships and container availability that could impact the supply chain.

Out of a total power requirement of about 40 MW the company has successfully installed a solar plant of 5.5 MW and has a project of further 5.5 MW in progress. An efficient generator has also been installed to help reduce fuel costs for the company. This is a part of the company’s ongoing efforts to conserve energy costs as it faces a drop in profitability. GADT currently has a cost of electricity of about PKR 32-35 per unit depending on utilization and the gas mix used.

The company requires about 70,000 bales of cotton annually for its raw material requirements. It sells 25-30% of its yarn to group companies and the remainder to external customers.

The management at the moment is working under the assumption that USD PKR parity will reach PKR 325/ USD by Dec 2024.

The company has been impacted by the high cost of capital, rising energy prices and a slowdown in global demand.

As a result, it is making efforts to reduce energy costs. It is also hopeful of the financing costs to begin gradually falling in 3-6 months. Going forward it expects profitability to recover as demand recovers.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under

no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has

been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase

Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time,

Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be

interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have

business relationships, including investment banking relationships with the companies referred to in this report This report is

provided only for the information of professional advisers who are expected to make their own investment decisions without undue

reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising

from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject

to market risks This report may not be reproduced, distributed or published by any recipient for any purpose