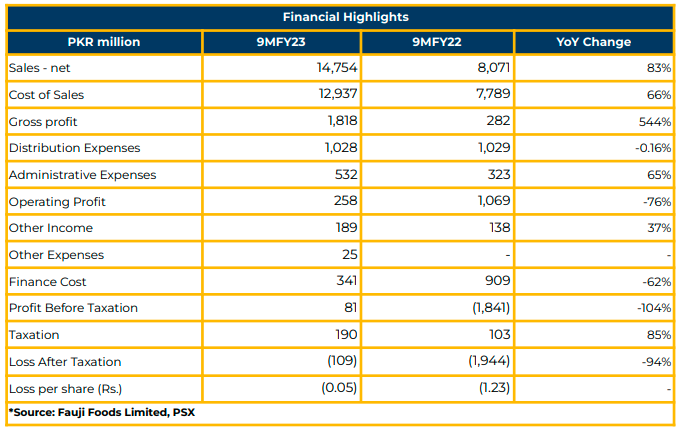

In 9MFY23, Fauji Foods Limited experienced a net loss of PKR 108.75 million (LPS: PKR 0.05), a significant improvement from the net loss of PKR 1.94 billion (LPS: PKR 1.23) in the corresponding period of the previous year.

The Company’s revenue exhibited a notable increase to PKR 14.75 billion in 9MFY23, marking an impressive 83% YoY growth from the PKR 8.07 billion reported in the same period last year.

The value growth in each segment was reported as follows: FFL total (78%), UHT (108%), Butter (32%), while LTW witnessed a drop of 25% YoY in 3QFY23. On the other hand, total growth of total value-added products grew significantly by 129% YoY such as cream by 109%, cheese excluding Pizza Hut (60%), FM (42%) in 3QFY23.

The total distribution business grew 121% YoY in 3QFY23 compared to 72% YoY in SPLY. The Metro Regions Such as Lajore expanded by 67%, Rawalpindi 97%, and Karachi 166% in 3QFY23. Conversely, Gujranwala distribution increased by 80%, Peshawar 242%, and S&B 105% during the period under review.

The Company also achieved an award in the dairy category for Nurpur, beating Olper’s and Milkpack in brand salience metrics.

In 3QFY23, FFL witnessed a 50% YoY increase in net sales revenue to PKR 4.92 billion compared to PKR 3.27 billion in FY22. Similarly, the Company posted a net profit of PKR 38.56 million in 3QFY23, compared to a net loss of PKR 690.43 million in SPLY.

The main focus of the Company is to increase the value-added portfolio with margin-accretive launches. Energy efficiency through solar power and cost efficiency through the conversion of 1500 ml is the Company’s strategy.

Regarding FFL’s stake in pasta and cereal businesses, the management shared that it is subject to regulatory approvals. The key categories of cereal include flakes & coated cereals, porridge, and desserts, while those of pasta are pasta long and short formats.

The management reported the market size of branded cereal at PKR 4.6 billion with a total business volume of 3,200 tons. The local business consists of 70%, and the imported cereal market constitutes 30% of total demand.

The management shared that the inclination of companies in Pakistan towards import substitution, due to the present turmoil in the market, is a great opportunity for them, and they will benefit from this opportunity by offering their products. This is the reason they secured contracts from McDonald’s and Unilever.

Going forward, the management aims to introduce new launches in different categories to achieve the growth target of PKR 100 billion in the next five years. With acquisitions, the Company plans to achieve PKR 50 billion in revenue in the next three years. The growth of the retail segment is the biggest part of this strategy.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.