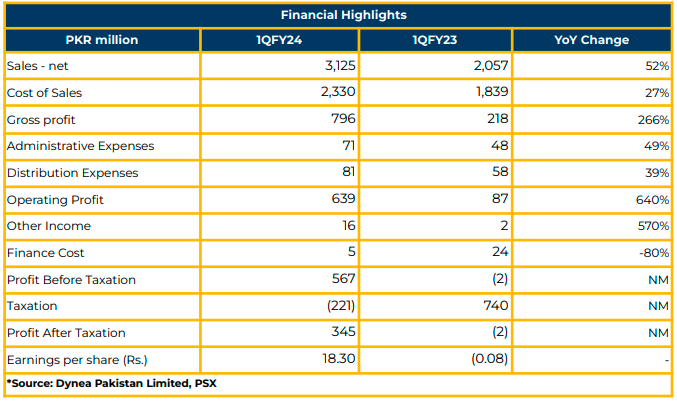

In 1QFY24, Dynea Pakistan Limited demonstrated substantial growth, with net profit reaching PKR 345.33 million (EPS: PKR 18.30) from a net loss of PKR 1.53 million (LPS: PKR 0.08) in the corresponding period of the previous year.

The Company’s revenue saw a notable increase to PKR 3.13 billion in 1QFY24, marking a 52% YoY growth from the PKR 2.06 billion reported in the same period last year.

Cost of sales experienced a notable rise of 27% YoY to PKR 2.33 billion in 1QFY24 from PKR 1.84 billion in the prior year. In contrast, administrative and distribution expenses increased by 49% YoY and 39% YoY to PKR 70.93 million and PKR 81.09 million in 1QFY24.

The finance cost of the Company decreased by 80% YoY to PKR 4.71 million in 1QFY24. Both gross profit and operating profit recorded substantial increases of 266% YoY and 640% YoY, reaching PKR 795.83 million and 639.74 million, respectively, in 1QFY24.

In FY23, DYNO witnessed a 16% YoY increase in net sales revenue to PKR 11.08 billion compared to PKR 9.54 billion. The surge in the top line was attributed to product price increases, leading to a profit before tax of PKR 1.08 billion in FY23.

Despite macroeconomic challenges, the sales quantity of the Company increased by 10% YoY to 92,874 M. Tons, resulting in a 7% YoY increase in profit after tax to PK 665 million (EPS: PKR 35.25) in FY23, compared to PKR 622 million (EPS: PKR 32.93) in FY22.

Total assets and shareholder’s equity grew by 17% YoY and 18% YoY to PKR 4.56 billion and PKR 3.43 billion, respectively, in FY23.

In the Resin Division of Hub Unit, the total capacity of Formaldehyde and Urea/Melamine Formaldehyde is 39,000 M Tons per annum and 26,000 M.Tons per annum, respectively. However, the Resin plant is operating at less than 80% capacity due to low demand in the market.

The total capacity of the Moulding Compound division in the Hub Unit is 7,000 M.tons per annum Formaldehyde capacity increased to 30,000 M. Tons per annum after debottlenecking in the Resin Division of Gadoon Unit in 2022. Additionally, the total capacity of Urea/Melamine Formaldehyde was reported at 51,000 M.Tons per annum.

The second plant of Formaldehyde in Gadoon Unit consists of a 50,000 M. Tons per annum capacity since 2018. The capacity of the Moulding Compound division is 7,500 per annum, and that of MCP and Glaze is 7,500 M. Tons per annum and 2,000 M. Tons per annum respectively.

Presently, Dynea Pakistan is operating the Moulding Compound plant at 90%. The Company has a concentration of customers for Moulding Compounds for the production of Melamine-based Crockery in Rawalpindi. The high-margin product is Moulding Compound, while Resin demand is under pressure, as discussed by the management.

Management reported the successful commissioning of a 1MW solar power plant on a 500-acre land in June 2023 and aims to add another 4MW to increase dependence on renewable sources.

The company maintains an inventory for three to four months on average. Due to low demand in previous months, DYNO is likely to carry 10-15% excess inventory and plans to rationalize low inventory going forward. In Afghanistan, DYNO exported 800,000 tons against the target of 100,000 tons. Moreover, the leads of exports to Africa are nearing maturity. Raw material constitutes 80% of total annual products, with the average price of Methanol at $330 per ton, which increases in winter.

Regarding the adhesive market, the management acknowledged challenges due to the informal nature of the market.

Going forward, the management foresees an increase in international prices of raw materials. Moreover, demand will remain a key challenge for the Company due to the ongoing macroeconomic situation in the country. Additionally, the Company aims to operate plants at their full capacity.

The management indicated that DYNO is evaluating options to localize raw materials with low CAPEX that the Company can source from internal cash instead of going for debt. Moreover, the Company is targeting zero debt given the current high interest environment in the country.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.