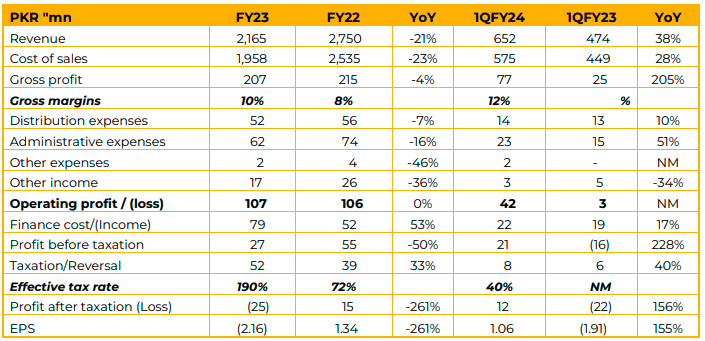

During FY23, net sales of the company clocked in at PKR 2.1bn, down by 21% YoY, compared to PKR2.7bn in SPLY. Similarly, the company reported loss after tax of PKR425mn (LPS: PKR2.16/sh), marking a significant decline of 2.6x YoY compared to PAT of PKR15mn (EPS: PKR1.34/sh) in SPLY.

While, on a quarter basis, the company achieved the profit after tax of PKR12mn (EPS: PKR1.06/sh) during 1QFY24, against the loss of PKR22mn (LPS: PKR1.91sh) in SPLY. Production and sales volume significantly decreased during the FY23. Whereas, casting production fell by 48.58% to 4,824 MT, and sales dropped by 41.9% to 5,586 MT.

Heavy monsoon rains caused devastating floods, damaging roads and bridges, halting transportation in Baluchistan. This led to economic challenges like low foreign reserves, high inflation, and disrupted supply chains.

The economic downturn, exacerbated by floods, resulted in a 46.11% decrease in farm tractor production, thus resulted into major impact on company’s profitability.

Despite lower production and sales, the company ended almost at break even. Efficient production, use of local raw materials, and reduced fixed costs contributed to monthly break-even dropping from 700-800 M.T to 400-500 M.T. A major achievement in the year was the company’s shift to

local substitutes, replacing 70-80% of imported raw materials. This move significantly benefited the company by addressing supply chain constraints.

According to the management, Millat Tractors and Al Ghazi Tractors account for the majority of total sales. Additionally, the recent substantial recovery in tractor demand has instilled confidence in the company that this resurgence will lead to an increase in casting sales.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose