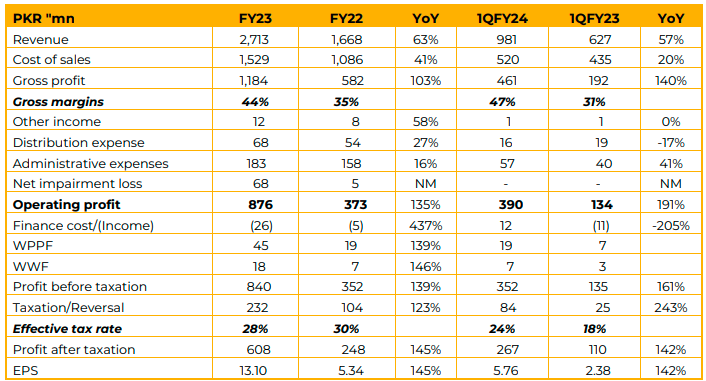

The company achieved a notable increase of 63% YoY in net sales, reaching PKR2.7bn in FY23, compared to PKR1.6bn in SPLY. Gross profit experienced a substantial 103% growth, totaling PKR1.2bn, up from PKR581.98mn in the previous year. The net profit after tax clocked in at PKR607.68mn (EPS: PKR13.10/sh) compared to PKRF248mn (EPS: PKR5.34/sh) in SPLY.

Despite challenges such as currency devaluation, high costs of imported raw materials, and supply chain disruptions, the company maintained stable profitability. Notably, export sales and transactions with the Oil and Gas sector saw substantial growth, while blasting activities in large construction projects decreased due to project completions.

The company successfully entered the export market, particularly targeting Africa, with successful supplies to North Sudan. However, delays in export proceeds were experienced due to the eruption of war and disruptions in Sudan’s banking system. Management has received confirmation of fund transfer initiation, expressing confidence in imminent payment receipt.

As part of its strategic approach, the company will continue to promote exports, focusing on other African countries. Significant supplies were directed to the oil and gas and mining sectors, compensating for decreased supplies to other sectors amid the economic downturn.

Additionally, the company allocated PKR37mn in capital investments during the year to maintain manufacturing capacity. Looking ahead, the Company aims to strengthen its local market position, capitalizing on opportunities from mega projects including Reko Diq and allied infrastructure projects. Exploration of international markets, specifically in Africa, remains a priority.

The management is actively pursuing Infrastructure Development projects in the country, including involvement in CPEC projects like ML-1, and hydropower projects such as Kohala, Diamer-Bhasha, and Balakot, is underway to maximize market share.

Biafo is strategically focused on expanding into the African market and targeting new opportunities, especially in the mining sector, aligning with prospective large-scale mining projects in the country.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject to this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed, or published by any recipient for any purpose.