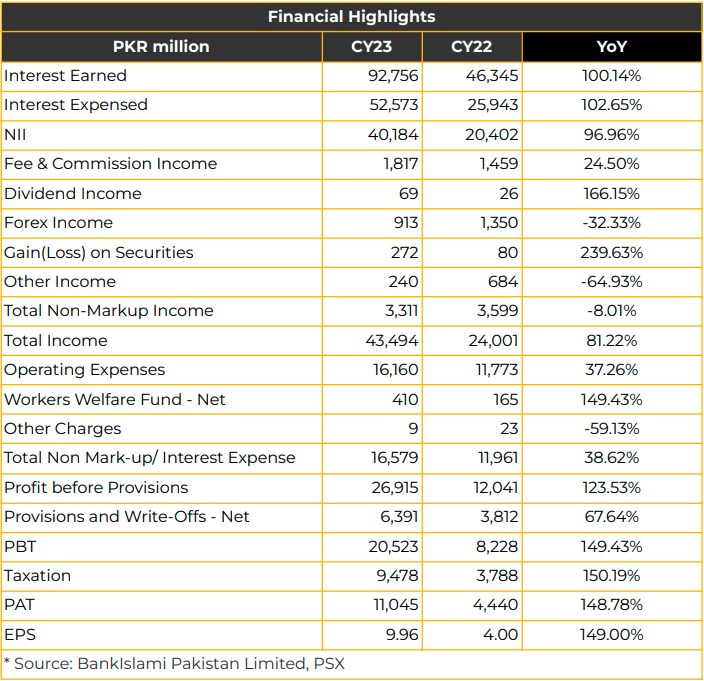

In CY23, the bank reported a robust profit of PKR 11.05 billion (EPS: PKR 9.96), marking a substantial 149% YoY increase compared to PKR 4.44 billion (EPS: PKR 4.00 per share) in SPLY. Profit Before Tax (PBT) stood at PKR 20.52 billion, a notable improvement from PKR 8.23 billion in the corresponding period.

The bank’s Net Interest Income (NII) grew impressively by 97% to reach PKR 40.18 billion in CY23, compared to PKR 20.40 billion in CY22. Fee and commission income increased by 25% to PKR 1.82 billion in CY23, compared to PKR 1.46 billion in SPLY.

However, foreign exchange declined by 32% YoY, reaching PKR 913.31 million in CY23. Total Non-mark-up income declined by 8% YoY to PKR 3.31 billion. Total income witnessed a substantial increase of 81% to PKR 43.49 billion compared to PKR 24 billion in SPLY. This growth was attributed to a healthy balance sheet and higher policy rate, resulting in improved net spreads and increased Net Interest Margins (NIMs).

In CY23, the shareholding of JS Bank in BIPL increased from 9% to 75.12%, making it the subsidiary of JS Bank Limited while 12.53% shares of BIPL are owned by Mr. Ali Hussain & SAJ Capital Management Limited.

Additionally, the bank’s net provisions increased significantly by 68% to PKR 6.39 billion compared to PKR 3.81 billion in SPLY, reflecting additional charges related to both objective and subjective classifications, as well as general provisions.

The bank’s tax payments also increased by 149% to PKR 20.52 billion during the period under review. On the balance sheet side, the bank saw a 34% YoY growth in total assets, totaling PKR 654.87 billion in CY23. Net advances and net investments increased by 14% YoY and 41% YoY, respectively, during the same period in CY23.

The advances portfolio comprised corporate advances (77%), SME (4%), agri (2%), and Consumer (17%). Notably, consumer financing in auto and housing declined by 29% and 7% in CY23 due to macroeconomic challenges. The bank enjoys the largest market share in housing finance.

The net investment portfolio comprises federal government securities (88.47%), Non-Government Securities (1.49%) and Pakistan Energy Sukuks (9.82%).

The bank reported that 97% of investments are floater with repricing in six months.

The deposits’ market share grew by 1.8% in CY23 compared to 1.4% in CY18. Likewise, the bank experienced an increase of 1.9% in the market share in net financing while that of investment increased by 1.2% in CY23.

BIPL experienced growth in deposits 26% YoY, reaching PKR 522.54 billion. The Current Account (CA) deposits grew by 14% YoY to PKR 194.99 billion in CY23. The total investment increased by 75% YoY to PKR 314.08 billion while total financing increased by 14% YoY to PKR 230.19 billion during the period under review.

The deposit mix consists of Current (37%), Savings (25%), and Term (38%) deposits.

Total equity increased to PKR 34.47 billion in CY23, marking a 38% YoY increase compared to PKR 2645 billion in SPLY. The delinquency ratio NPL Islamic portfolio and the total portfolio were reported at 6.9% and 22.5% due to prevailing economic conditions in CY23.

The coverage ratio of the total portfolio is 104.15% while that of the Islamic portfolio is 105.86%.

The return on Average Equity, infection ratio, and coverage ratio were reported at 39.81% (20.78% in CY22), 9.01%, and 104.15% in CY23. Gross Advances to deposits ratio stands at 48.62 in CY23 as compared to 52.98% in SPLY.

The Cost-to-Income ratio stood at 37.15% in CY23, while Return on Earning Assets and Capital Adequacy Ratio (CAR) were reported at 2.27% and 23.79%, respectively. BIPL has the highest CAR in the industry.

The CASA (Current Account Savings Account) composition decreased to 62% from 67% in SPLY. BIPL operates in more than 150 cities with over 440 branches in the country. The distribution of branches is 19% in rural areas and 81% in urban areas. With the focus on providing unbanked areas in Pakistan, the bank plans to launch 100 new branches by the end of this year.

Going forward, the bank plans to increase auto financing aggressively. Management anticipates growing the balance sheet and other income as a result of lower policy rates this year. BIPL management expects a rate cut in June 2024 based on inflation expectations of around 19% and other economic conditions.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject to this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.