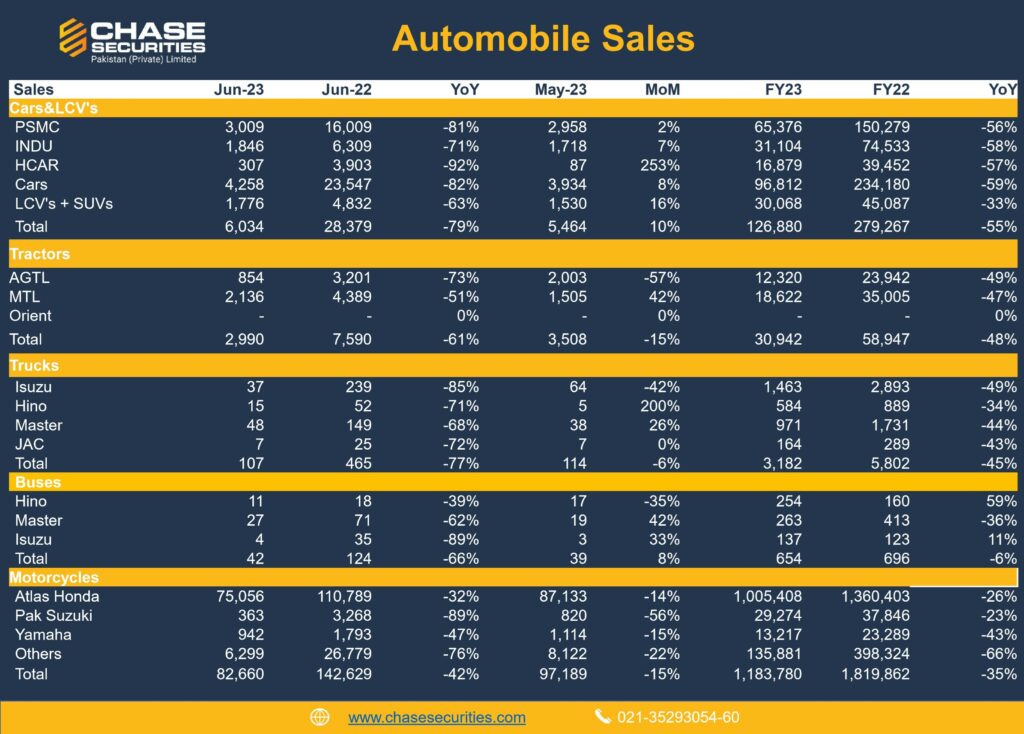

As per PAMA, Pakistan car sales increased by 9% MoM to 5.7K units in Jun’23. However, sales declined by 80% YoY during the period. In Jun’23, all companies recorded a decline on YoY basis due to non-availability of CKD parts.

Cumulatively, during FY23, the total car sales clocked in at 127K units down 55% YoY, as compared to 279K units in SPLY. The substantial drop in sales is primarily attributable to non-availability of CKDs, low economic activity, cost-led price hikes and expensive auto financing.

Segment wise, PSMC posted a growth of 2% MoM to 3K units in Jun’23. However, the company witnessed a decline of 56% YoY in FY23 to 65K units as compared to 150K units sold in SPLY.

Honda Atlas Car remained the top performer MoM, with 2.5x increase in sales to 307 units. While, in FY23, HCAR sales plunged by 57% YoY to 16.8K units as against 39K units in SPLY.

Indus Motors (INDU) posted a decline of 71% YoY to 1.8K units in Jun’23 compared to 6.3K in Jun’22. Sales improved by 7% MoM in Jun’23.

Tractor sales went down by 61% / 15% YoY / MoM in Jun’23. MTL sales plunging by 51% YoY, while AGTL sales down by 73% YoY in Jun’23, respectively.

Trucks sales were down by 6% MoM while Buses sales showed an increase of 8% MoM in Jun’23. This took FY23 sales of Trucks to 3.2K units down 45% YoY, and Buses sales to 654 units, amid drop in transportation activity followed by a slowdown in economy.

Motorbikes sales clocked in at 82K in Jun’23, down by 42% YoY / 15% MoM. Overall, bikes sales were down by 35% YoY in FY23 to 1,183K as compared to 1,820K in FY22.