Key Takeaway:

Highnoon Laboratories to Establish Fourth Manufacturing Facility, Primarily Targeting Export Markets:

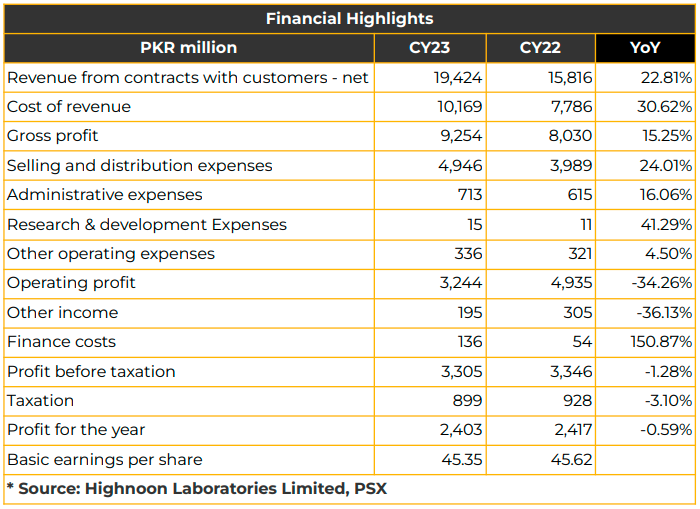

In the CY23, Highnoon Laboratories Limited disclosed a net profit of PKR 2.40 billion (EPS: PKR 45.35), reflecting a slight decrease of 0.59% year-on-year from PKR 2.42 billion (EPS: PKR 45.62) in the same period last year (SPLY). The downturn in profitability was attributed to higher inflation and partially passed on price increase. Net sales experienced a 23% growth to PKR 19.42 billion in CY23 compared to PKR 15.82 billion in CY22.

Management attributed the growth in top line to the diversified portfolio of the Company and boost in the sales of cardiology and metabolic drugs. Moreover, the organic growth of business and price increases contributed toward this revenue growth.

HINOON ranks twelfth out of 700 pharmaceutical companies with three manufacturing facilities (Two pharmaceutical and one Nutraceutical). The

pharmaceutical company focuses on the cardiology, respiratory, and metabolic segments.

Management highlighted the acquisition of 12 acres of land for establishing its fourth manufacturing facility at Quaid-e-Azam Business Park in Lahore. The facility is anticipated to become operational within the next three years. Its primary focus will be on export markets such as the Middle East, Africa, Malaysia, and Indonesia. Enjoying status as a Special Economic Zone (SEZ) entity, the company stands to benefit from a ten-year tax rebate and resultant tax savings.

With a five-year annual CAGR of 17%, the five brands of the Company contribute PKR 1 billion to the revenue. Highnoon made it to Forbes Asia’s Best Under a Billion list for the fourth time in CY23. Management announced 25% bonus shares and a dividend of PKR 30 per share in CY23.

ROE and ROA were reported at PKR 25.93% and 18.63% in CY23. The Company is consistently growing with a ten-year CAGR of 20.68%. Among industry peers, HINOON enjoys the highest gross margins of 48%, net margin of 12% and cash dividend payout of 80%. Apart form this, Pharma company reinvested PKR 1.4 billion on technology and people in CY23.

In Cardiometabolic, HINOON has a business portfolio of PKR 6.4 billion with market leadership in seven categories while four products are leading the market in the respiratory segment with a business portfolio of PKR 3.8 bn. The Anti-Infective segment has a business portfolio of PKR 4.6 billion with one category being the market leader.

The top ten products of the company include Combivair (PKR 1.4 billion), Tagipmet (PKR 1.2 billion), Cyrocin (PKR 1.5 billion), Kestine (PKR 1.2 billion), Ulsanic (PKR 1.0 billion), Misar (PKR 810 mn), Ceftro (PKR 667 million), Tres-Orix Forte (PKR 693 million), Efix (PKR 635 million), Axesom (PKR 782 million). These products constitute 47% of the Company’s total value.

HINOON is currently exporting 215 products with 130 more products in the pipeline. Profit Before Tax amounted to PKR 3.30 billion, registering a 1.3% year-on-year decrease from PKR 3.35 billion in the SPLY.

Higher inflation caused a 24% YoY increase in Selling & Distribution expenses (PKR 4.95 billion) and 16% YoY increase in administrative expenses (PKR 713.35 million). R & D expenses and other operating expenses also increased by 41% YoY and 5% YoY, respectively, during the said period.

Cost of sales surged by 31% to PKR 10.17 billion in CY23 compared to PKR 7.79 billion in CY22 while finance cost significantly increased to PKR 136.47 million from PKR 54.40 million in SPLY. Other income witnessed a significant decline, down by 36% year-on-year to PKR 194.79 million.

Gross profit decreased by 15% to PKR 9.25 billion in CY23 from PKR 8.03 billion in CY22 due to increased costs and the inability to entirely pass on the full price increase to consumers.

Going forward, selling and distribution expenses are likely to remain high due to inflation and the company’s growth strategy. Moreover, management indicated the deregulation of non-essential drugs as a positive initiative for the benefit of the pharmaceutical companies in Pakistan. The dividend policy will be in line with the growth strategy of the Company.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject to this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.