In FY23, Blue-Ex Limited reported a record unconsolidated profit of PKR 166.37 million, indicating an 84.20% YoY increase from PKR 15.95 million in the corresponding period of the previous year.

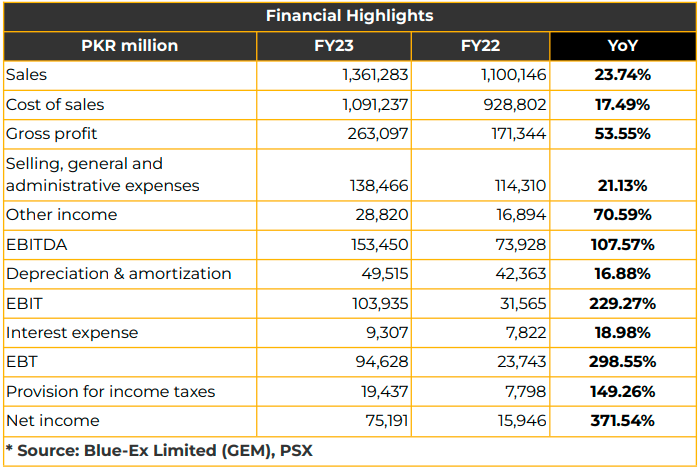

Blue-Ex witnessed an increase of 17% in cost of sales, amounting to PKR 1.09 billion while revenue increased by 23% to PKR 1.35 billion in FY23. The gross profit increased by 53.5% to PKR 263.09 million.

Selling, general and administrative expenses increased by 21% to PKR 138.47 billion while other income increased by 70.6% in FY23.

The total assets of the Company increased by 4% in FY23 to PKR 1.07 billion while total liabilities decreased by 17% YoY to PKR 208.18 million.

The group structure consists of Blue-Ex as a parent company with Universal Freight Systems (Pvt) Limited and Shyp. guru as subsidiaries. The former was acquired last year for the North American market.

The key partners of this transport company are Aramex, IATA, FJ, and Abhi. The company provides finance to its customers through Abhi.

Blue-Ex commenced its E-commerce operations in 2011 and is the only IATA-certified courier company in Pakistan. It is the only transport company listed on PSX in its category

Management reported that 98% of all freight movement is being undertaken via the road network in Pakistan Going forward, Blue-Ex anticipates growth in B2B and B2C businesses, documented exports, and high revenue streams as Amazon has added Pakistan to its sellers list.

Additionally, the company aims to expand in East and South East markets due to its expanding middle class. The revenue is expected to grow at a CAGR of 5.85% in E-Commerce, resulting in a projected market share of USD 6,530 million by 2029 with Average Revenue Per User (ARPU) amounting to USD 482.60.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject to this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed, or published by any recipient for any purpose.