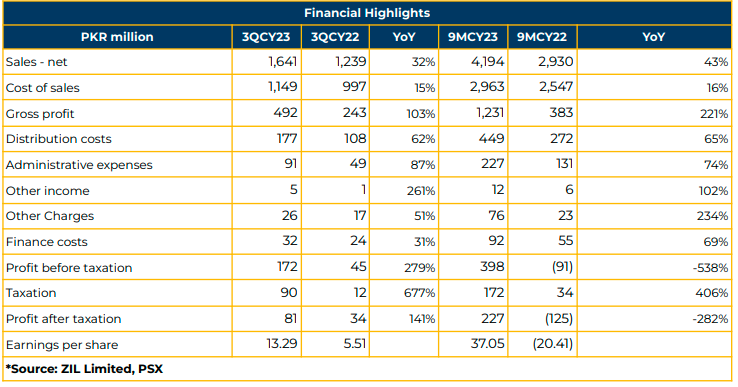

In 9MCY23, ZIL Limited reported a net profit of PKR 226.80 million (EPS: PKR 37.05), reflecting a significant increase from the net loss of PKR 124.93 million (LPS: PKR 20.41) in the same period last year (SPLY).

The company’s topline experienced a notable 43% YoY surge to PKR 4.19 billion in 9MCY23, the highest ever recorded for a nine-month period, compared to PKR 2.93 billion in the corresponding period of the previous year. Gross Profit also witnessed substantial YoY growth, reaching PKR 1.23 billion in 9MCY23, up from PKR 382.91 million in SPLY. Similarly, Gross profit margins increased to 30% with PAT of PKR 81.36 million in 3QCY23.

Cost of sales amounted to PKR 2.96 billion in 9MCY23, reflecting a notable increase of 16% YoY from PKR 2.55 billion in the corresponding period last year. Other income saw a significant rise of 102% YoY to PKR 12.37 million, compared to PKR 6.13 million in SPLY.

Distribution expenses and administrative expenses increased by 65% YoY and 74% YoY to PKR 449.41 million and PKR 227.31 million, respectively, while finance costs witnessed a 69% YoY increase to PKR 92.45 million in 9MCY23.

The Profit Before Tax (PBT) for 9MCY23 increased to PKR 398.33 million, compared to a loss of PKR 91.03 million in SPLY.

The holding company of ZIL is New Future Consumers International general trading (NFCI) LLC Dubai from 2023. In 2005, the company registered revenue of PKR one billion, PKR 2 billion by relaunching Capri in 2017, and PKR 3.2 billion in 2019.

The products of the company comprise two categories: Beauty and Health Segment. Capri Moisturizing is the top product in the beauty category, with the company’s market share standing at 12-13%, and continuously increasing in the beauty segment.

The prices of raw materials significantly increased in 9MCY23 due to higher inflation. ZIL imports most of its raw materials. The fatty raw material constitutes around 80% of the total cost, and the company procures soap noodles from local vendors.

Going forward, ZIL is going to launch new categories in food and personal care products to diversify the portfolio. The R&D for these products is underway, and ZIL plans to manufacture products in Pakistan.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.