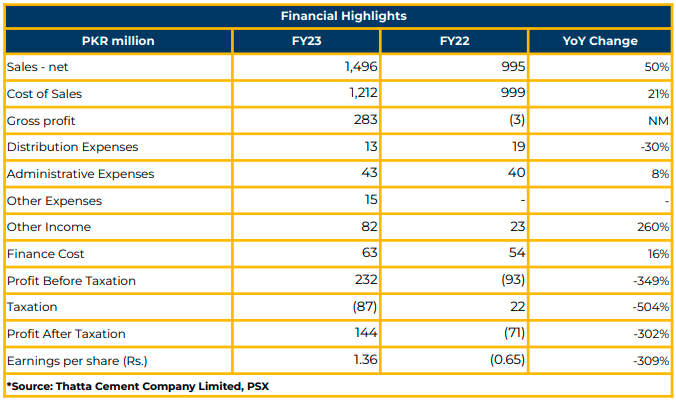

In 1QFY24, Thatta Cement Company Limited (THCCL) achieved a net profit of PKR 144.39 million (EPS: PKR 1.36), marking a significant turnaround from the net loss of PKR 71.34 million (LPS: PKR 0.65) in the corresponding period of the previous year.

The company’s revenue experienced a notable surge, reaching PKR 1.45 billion in 1QFY24, indicating substantial 50% YoY growth from the PKR 995.38 million reported in the same period last year.

Cost of sales increased by 21% YoY to PKR 1.21 billion in 1QFY24 from PKR 998.56 million in the prior year. In contrast, administrative expenses increased by 8% YoY to PKR 42.74 million while distribution expenses decreased by 30% YoY to PKR 13.40 million, respectively, in 1QFY24.

The finance cost of the company increased by 16% YoY to PKR 62.61 million in 1QFY24 from PKR 53.77 million in SPLY. Gross profit recorded substantial increases, reaching PKR 283.41 million in 1QFY24.

In FY23, THCCL witnessed an increase of 26% YoY to PKR 5.53 billion compared to PKR 4.39 billion in FY22. Gross profit increased by 38% YoY to PKR 658.97 million during the period under review. Profit after tax increased by 258% YoY to PKR 309.67 million (EPS: PKR 3.11) in FY23 as compared to PKR 86.43 million (EPS: PKR 0.99) in FY22.

In 1QFY24, cement sales were recorded at 108,540 tons, surpassing the sales in 1QFY23 (90,287 tons). The recent buyback by the company is anticipated to improve the breakup value and earnings per share.

THCCL is acquiring 30% of its total energy needs from Waste Heat Recovery Power (WHRP) and solar power. In June 2023, THCCL successfully completed a Solar Power plant with an installed capacity of 1.3MW. An additional 2.2MW is expected to be installed by the end of 2QFY24.

This shift towards renewable energy sources will save 20-25% in energy costs.

Management indicated that the retention per ton of cement increased by 30% in September 2023. Moreover, the company relies 100% on local coal, expected to reduce energy costs by 15-20% in 2QFY24. With no long and short-term loans on books, the company plans to invest the additional cash in the expansion plans.

The MRP of cement was given above PKR 13,000. The landed price of coal to the factory was estimated at PKR 15,000 per ton in 1QFY24, compared to PKR 19,000 per ton in FY23.

Going forward, the management expects a positive outlook for the economy and foresees sustained profitability in the upcoming quarters.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose