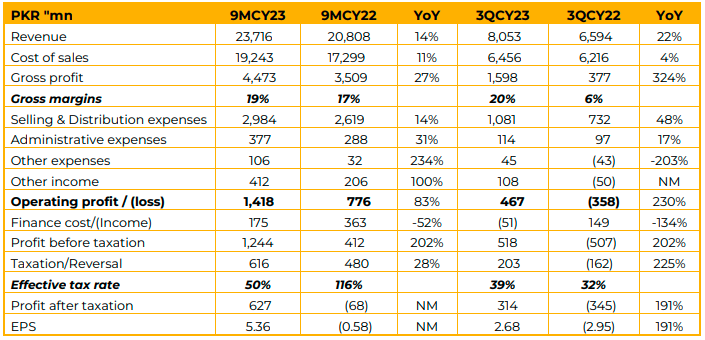

The company achieved an increase of 14% YoY in net sales, reaching at PKR23.7bn in 9MCY23, compared to PKR20.8bn in SPLY. Gross profit experienced a substantial 27% growth, totaling at PKR4.5bn, up from PKR3.5bn in previous year. The net profit after tax clocked in at PKR627mn (EPS: PKR5.36/sh) compared to loss of PKR68mn (LPS: PKR0.58/sh) in SPLY.

Haleon Pakistan experienced a robust 22% growth in its core business during Q3, driven by focused team efforts and sustained performance of established brands in the country. However, there was a significant decline of 58% in Net Sales Toll and Exports compared to the previous year.

In the Fast-Moving Consumer Goods (FMCG) segment, Haleon Pakistan exhibited a positive growth trend of 4%, primarily attributed to the Oral Health category. The Brands Portfolio comprises FMCG (13% of business) and OVER THE COUNTER (87% of business), regulated by DRAP.

The quarter witnessed exchange rate instability, particularly with a declining trend in September 2023. Despite high interest rates, the company generated income of PKR368mn from financial assets, compared to PKR161mn in the same period last year.

Notably, the top three brands—Panadol, CAC, and Sensodyne—contributed 80% to the total turnover. Key launches included Herbactive, Parodontax, and Sensodyne Complete Protection. Herbactive achieved a 30% customer retention rate.

The company anticipates the launch of Panadol Night in January 2024 and Sensodyne Kids within the next 4–5 months, recognizing substantial potential in Panadol Night as a blockbuster product in other countries.

In terms of the ongoing CPI adjustment, management informed that it is pending in court and is hopeful for resolution in the next couple of months.

A strategic move for Panadol enhancement involves insourcing full volumes of the Panadol portfolio to Jamshoro, with USD10mn investment to expand production capacity to 8bn tablets. This initiative aims to bring the latest manufacturing technology to Pakistan and cater to the

country’s pharmaceutical and Over-the-Counter medicine needs. The company plans to export the product with increased capacity by 2025, expecting better margins.

Moreover, the company is currently not manufacturing any Panadol, in-house production is expected to commence within two months. The management is confident that, post-completion of the project and stabilization in commodity prices, the company will maintain its historically high margins of 25%.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose