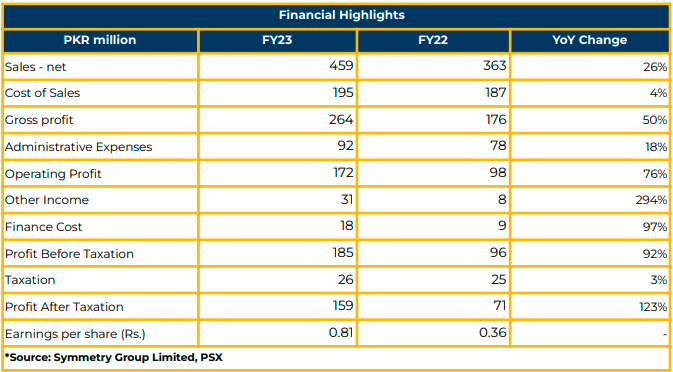

In FY23, Symmetry Group Limited demonstrated significant growth, with net profit reaching PKR 158.82 million (EPS: PKR 0.81), indicating a robust growth of 123% YoY from PKR 71.30 million (EPS: PKR 0.36) in the corresponding period of the previous year.

The Company’s revenue experienced a notable increase, reaching PKR 459.46 million in FY23, marking a substantial 26% YoY growth from the PKR 363.29 million reported in the same period last year.

The primary revenue contributions came from transformative (64%) and interactive (36%) segments in FY23, with local business contributing 62% and exports 38%. In exports, MENA and North America contributed 31% and 7%, respectively, in FY23.

Revenue from various industries included banks & financial institutions, including insurance companies (33%), technology (18%), Telcos (17%), FMCG (16%), Trading (13%), and others (3%).

Cost of sales increased by 4% YoY to PKR 195.29 million in FY23 from PKR 187.29 million in the prior year. In contrast, administrative expenses increased by 18% YoY to PKR 92.22 million in FY23.

The cost structure comprised HR cost (56%), traveling (10%), IT (9%), entertainment (4%), and other expenses (21%), with all employees being from Pakistan.

The finance cost of the Company increased by 97% YoY to PKR 18.07 million in FY23 from PKR 9.17 million in SPLY. Both gross profit and operating profit recorded substantial increases of 50% YoY and 76% YoY, reaching PKR 264.17 million and 171.96 million, respectively, in FY23.

Total assets were recorded at PKR 597 million, with 76% current assets and 24% non-assets. Total liabilities were reported at PKR 170 million, with 28% current liabilities and 1% non-current liabilities in FY23. Equity was reported at PKR 427 million, comprising 71% of the total capital.

The group structure of the Company consists of Symmetry Digital (Pvt) Limited (99.98% shareholding) and Iris Digital (Pvt) Limited (99.80% shareholding).

The Company is engaged in four key areas of Interactive, Transformation, Commerce, and Mobility. The interactive segment offers marketing services, while Transformation provides Data Science and Technology-related services. The third segment offers E–Commerce deployment and other related services.The fourth segment provides SMS and voice messaging solutions to clients.

SYM also offers products such as Iris Digital, Corral, Servits, Mobits, Influsense.ai, and Corral Performance, offering 360-degree solutions from setting up a new digital business to technology-based solutions, including SaaS-based and cloud-based solutions. The Company reported progress on the ongoing development of five major products: Mobits (67%), Servit (67%), Influence (33%), Coral Performance (25%), and Cartsight (13%).

The first two IPs are expected to be completed by 3QFY24, while others are likely to be launched by 2QFY25. Cartsight, according to management, is anticipated to be a game-changer as it will gather data of thousands of shoppers, with deployment expected by December 2025.

In FY23, Symmetry Group renewed major contracts with Jazz, HBL, and JS Bank. Management also shared partnerships with Meta Business, Google, Microsoft, and Alibaba.

Moreover, the Company explored two new markets, North America and Qatar, during the same period. SYM successfully secured a partnership with the leading E-Commerce giant, Alibaba.com. The Company expands by collaborating with local companies in foreign markets instead of opening offices there. However, the opening of a branch in Qatar will be finalized after evaluating feasibility in a couple of months.

Going forward, the management foresees an increase in the number of mobile users, reaching 6.6% of GDP of Pakistan. In 2HFY24, management expects the commencement of operations of Mobits and Servits. The management shared that SYM is working to tap into the markets of KSA and Singapore to introduce their services. In Singapore, startups are the target, as the startup marketing is booming there. Moreover, equity investment in Data Science and AI is the main focus of the Company.

Additionally, the Company aims to achieve one billion rupees in revenue in the next two years based on expansion in the local market and exports. Furthermore, operational efficiencies, expansion, and investment in technology are key factors for the future growth of the business.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.