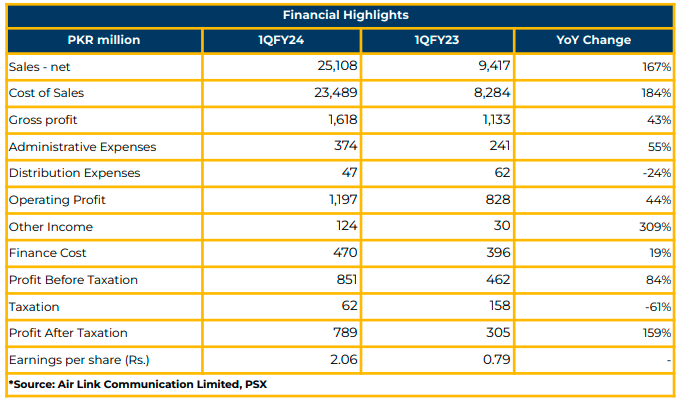

In 1QFY24, Air Link Communication Limited experienced robust growth, with net profit soaring to PKR 788.59 million (EPS: PKR 2.06), marking a 159% YoY increase from PKR 304.75 million (EPS: PKR 0.79) in the same period last year.

The Company’s topline exhibited a remarkable surge to PKR 25.11 billion in 1QFY24, a 167% YoY increase from the PKR 9.42 billion reported in the corresponding period of the previous year.

Cost of sales rose sharply by 184% YoY to PKR 23.49 billion from PKR 8.28 billion in the previous year. Conversely, administrative expenses increased by 55% YoY to PKR 374.65 million, while distribution expenses decreased by 24% YoY to PKR 47.26 million during the review period.

The finance cost of the Company increased by 19% YoY to PKR 470.38 million in 1QFY24. Both gross profit and operating profit witnessed a 43% YoY and 44% YoY increase, reaching PKR 1.62 billion and 1.19 billion, respectively, in 1QFY24.

In FY23, AIRLINK experienced a 37% YoY decrease in bottom line, amounting to PKR 961 million. The Company’s revenue also declined by 25% YoY to PKR 36.93 billion in FY23, compared to PKR 49.17 billion in FY22. This decline was attributed to restrictions on the opening of LCs and fall in foreign exchange reserves.

The Company anticipates commencing the manufacturing of Xiaomi’s Smart TV in Pakistan in March CY24, with the price point expected to fall

between that of Samsung and TCL smart TVs. Additionally, AIRLINK aims to achieve substantial growth in export volumes in FY24.

Capacity utilization increased to 69% in 1QFY24, up from 26% in FY23 and 36% in FY22. The Company’s revenue is divided into assembling (43% in FY23 vs. 85% in FY22)and distribution & retail (57% in FY23 vs. 15% in FY22).

Management projects earnings of approximately USD 15 billion in the next three to four years, contingent on the government providing tax incentives for the manufacturing and export of technological products.

Going forward, the management targets a revenue of PKR 100 billion by the end of FY24, building on the impressive performance in 1QFY24 (Revenue: PKR 25 billion). Furthermore, the management expects to secure tax incentives from the government for exporting the company’s manufactured products.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.