Chase Securities Portfolio Case Study: How 8M Grew to 25M on the PSX

Chase Securities portfolio case study: This real example shows how structured investing on the PSX turned PKR 8 million into PKR 25 million in just two years.

Most investors enter the Pakistan Stock Exchange (PSX) hoping to grow their money fast. Yet only a small number actually manage to compound wealth consistently.

The reason?

Most trade emotionally, chase tips, or give up when the market dips.

In this Chase Securities portfolio case study, the results reflect how disciplined, research-backed investing can outperform market noise.

Two years ago, a client started with PKR 8 million. Through disciplined allocation, sector rotation, and data-based decisions, that portfolio today stands at PKR 25 million. This guide explains exactly how that happened, and how you can apply the same principles.

How Smart Portfolio Management Built Long-Term Wealth on the PSX

Most investors step into the Pakistan Stock Exchange (PSX) hoping to grow their savings quickly, but lasting success comes from structure, not speed. At Chase Securities Pakistan, disciplined portfolio management, sector insight, and data-backed decisions turned a modest investment into long-term wealth. This real case study shows how consistent strategy, patient compounding, and risk control can outperform market noise, and how you can apply the same approach to your own portfolio.

Starting Point: Building the PKR 8 Million Portfolio

One key insight from this Chase Securities portfolio case study is that volatility becomes an advantage when backed by preparation and cash buffers.

When this portfolio began in 2023, the goal wasn’t to chase the hottest stocks, it was to compound steadily while managing downside risk. The initial allocation looked like this:

- 70% equities (large-cap blue-chips and high-dividend stocks)

- 20% defensive exposure (T-bills and money-market funds)

- 10% cash buffer for volatility opportunities

The focus was on companies with stable earnings, export exposure, and strong dividend histories, particularly in banking, energy (E&Ps), and fertilizers.

From the start, we applied three rules:

- Reinvest every dividend. Compounding happens quietly through reinvestment.

- Review quarterly, not daily. Emotional trading destroys performance.

- Never risk more than 10% in a single stock. Concentration kills in volatile markets.

The Strategy: Managing Through Volatility

Turning 8 million into 25 million required both patience and precision. Here’s how our team managed that journey.

1. Core Holdings and the Power of Compounding

Roughly half of the portfolio was anchored in dividend-rich blue-chips, banks, power companies, and fertilizer stocks. By reinvesting dividends averaging 10–12% annually, returns compounded even during sideways markets. Instead of chasing speculative rallies, the client earned a steady income stream that built resilience.

2. Tactical Sector Rotations

The remaining allocation was actively managed. In 2023, we increased exposure to cement stocks anticipating a construction recovery, and shifted to IT exporters during rupee weakness to capture dollar revenues. In 2024, as policy rates peaked, we rotated back into banks to benefit from net interest margins.

Each move was backed by data, not sentiment, sector P/E ratios, earnings revisions, and liquidity trends guided timing.

3. Risk Management Discipline

Every trade followed defined stop-losses. A 10–15% cash buffer was maintained to buy quality stocks during dips. The average holding period exceeded four months, long enough for investment theses to play out but short enough to stay flexible.

This combination of structure, patience, and opportunism allowed the portfolio to thrive even when the broader market faced volatility.

The Result: From PKR 8 Million to 25 Million

The results of this Chase Securities portfolio case study highlight how discipline and timing can generate returns well above the market average.

Two years later, the outcome speaks for itself.

- Total growth: +212%

- Benchmark comparison: KSE-100 gained +90% in the same period

- Portfolio composition at end-2025: 85% equities, 10% fixed income, 5% cash

- Return breakdown:

- 60% capital gains

- 25% dividend reinvestment

- 15% tactical reallocation

The portfolio didn’t achieve this by luck or leverage, it achieved it through consistency and data-driven decision-making.

Lessons Retail Investors Can Learn

Most Pakistani investors face similar pain points: they trade too much, follow online “tips,” and panic during corrections. This case study shows that wealth creation requires the opposite mindset.

- Focus on allocation: Decide your mix of equities, income, and cash before you buy anything.

- Reinvest dividends: Compounding is your quiet engine of growth.

- Stay disciplined during downturns: Market dips are opportunities, not disasters.

- Avoid over-diversification: Owning a few strong businesses is better than 30 random tickers.

- Measure success annually, not daily: Patience pays the biggest dividends.

By following these principles, even small portfolios can grow substantially over time.

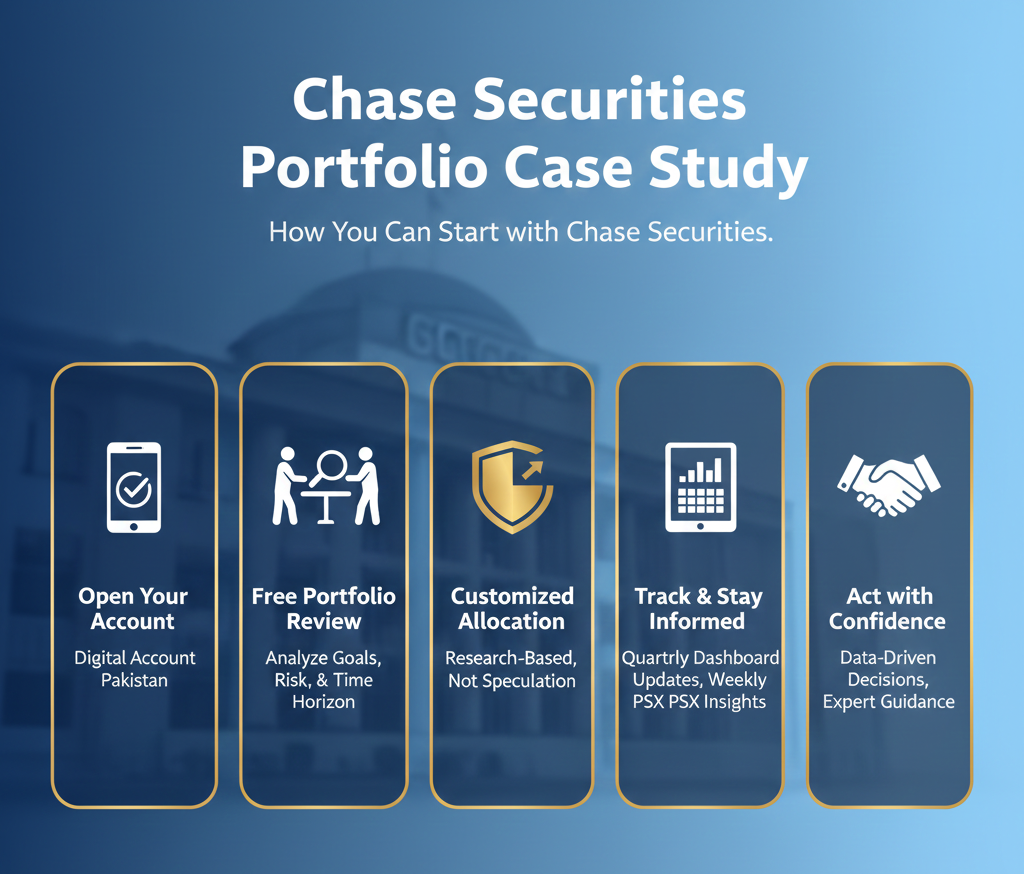

How You Can Start with Chase Securities

This Chase Securities portfolio case study highlights why starting with a clear allocation plan is more important than chasing hot stocks. If you’re inspired by this portfolio’s journey, here’s how you can begin:

- Open a digital account with Chase Securities Pakistan

- Schedule a free portfolio review. Our team analyzes your goals, risk appetite, and time horizon.

- Receive a customized allocation plan built on research, not speculation.

- Track performance quarterly through our client dashboard.

- Stay informed with our weekly PSX updates and sector insights.

This article is informational and not personalized investment advice. Always consult a licensed advisor before making financial decisions.

To start your investment journey, contact Chase Securities today, where data meets discipline.

Frequently Asked Questions

Q: What’s the minimum investment for a managed portfolio?

You can start with as little as PKR 500,000, giving you diversified exposure to PSX blue-chips.

Q: How often do you rebalance portfolios?

We typically rebalance quarterly or when valuations shift significantly.

Q: Are returns guaranteed?

No. Markets fluctuate, but disciplined risk management helps protect and grow capital.

Conclusion:

As this Chase Securities portfolio case study shows, consistent strategy beats speculation every single time.

The journey from 8 million to 25 million wasn’t about chasing luck, it was about structured portfolio management, research, and emotional discipline. In an unpredictable market, process beats prediction every time.

As more Pakistanis look to grow wealth beyond savings and real estate, the stock market offers unmatched potential, if approached intelligently. Chase Securities helps investors bridge that gap with strategy, structure, and transparency.

Talk to Chase Securities today to learn how disciplined investing can transform your portfolio, one data-driven decision at a time.