Key Takeaways:

• New products expected to launch next year.

• Profitability to improve in upcoming periods.

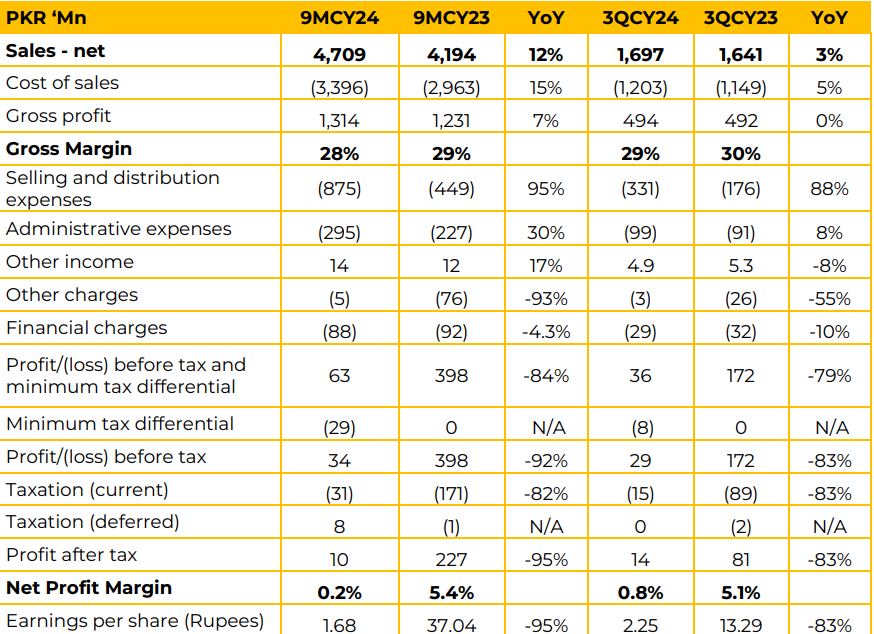

The company reported a 12% YoY increase in net sales during the nine months ended 9MCY24, rising from PKR 4,194 million to PKR 4,709 million. For 3QCY24, sales increased modestly by 3% YoY to PKR 1,697 million compared to PKR 1,641 million in 3QCY23.

Cost of sales rose by 15% YoY for 9MCY24, outpacing the growth in sales. This led to a 7% YoY increase in gross profit to PKR 1,314 million, with a slight contraction in gross margin from 29% in 9MCY23 to 28% in 9MCY24. For 3QCY24, gross profit remained flat at PKR 494 million, and the gross margin declined slightly to 29% from 30% in 3QCY23.

The marginal reduction in gross margin was due to increase in raw material prices and reduction in retail prices of the product as a marketing strategy. Operating expenses saw significant increases during 9MCY24. Selling and distribution expenses surged by 95% YoY to PKR 875 million.

Administrative expenses also rose by 30% YoY to PKR 295 million. These expense hikes heavily impacted profitability. For 3QCY24, selling expenses rose YoY to PKR 331 million, while administrative expenses grew 8% YoY to PKR 99 million.

Net profit for 9MCY24 decreased drastically by 95% YoY to PKR 10 million. Similarly, 3QCY24 profit after tax fell by 83% YoY to PKR 14 million. The net profit margin for 9MCY24 shrank to a negligible 0.2% from 5.4% in 9MCY23, reflecting significant margin compression.

Earnings per share dropped sharply by 95% YoY to PKR 1.68 in 9MCY24 compared to PKR 37.04 in 9MCY23. For 3QCY24, EPS declined by 83% YoY to PKR 2.25 from PKR 13.29 in 3QCY23, indicating the erosion of shareholder returns amid higher costs and muted profit growth. Going forward, the company is expected to launch new products in CY25.

According to the management, company’s current market share is 5.5%. With significant investment in selling and marketing expenses, the management expects the profitability to improve in upcoming periods

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.