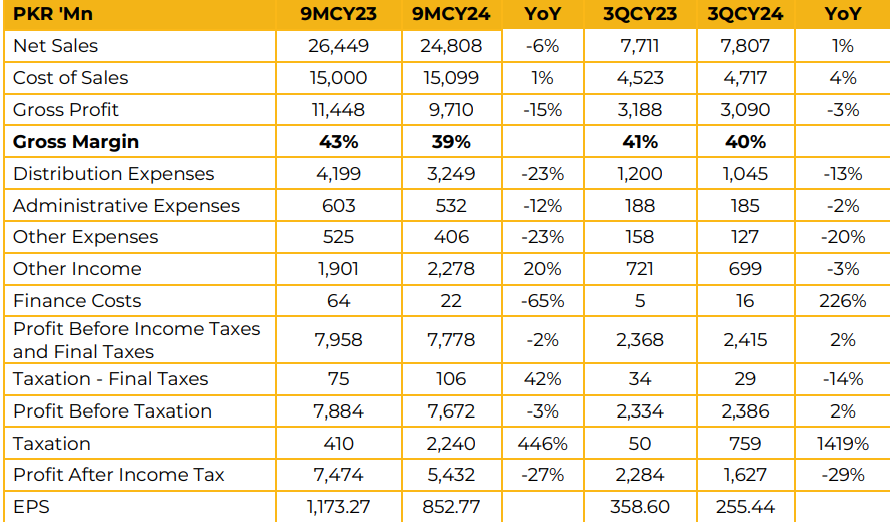

Unilever Pakistan Foods Limited reported a net profit of PKR 5.43 billion (EPS: PKR 852.44) in 9MCY24, reflecting a 27% YoY decline compared to PKR 7.47 billion (EPS: PKR 1,173.27) in the SPLY. Management stated that EPS declined by 27%. The decline was attributed to the expiration of the five-year tax credits secured following the equity injection in CY18. Revenue for 9MCY24 stood at PKR 24.81 billion, representing a 6% YoY decrease from PKR 26.45 billion in 9MCY23. The decline in net sales was attributed to lower consumer purchasing power driven by higher inflation in the country.

Management stated that the decrease in net sales was primarily due to a price reduction implemented in 1QCY24, particularly in the noodles category. Operating margins improved by 111 bps to 31.4% compared to the previous year. This improvement was driven by interest income earned on non-repatriated cash, apart from one single tranche, and sharp prioritization of advertisement and promotional expenses. In addition to price reductions, the company introduced price-pack interventions to cater to consumer needs.

Management reported that 60% of the portfolio comprises savoury products, followed by the B2B business at 20%, with the remainder distributed across other categories. Management emphasized health claims, highlighting that their products are sodium and MSG compliant.

They remain bullish on the overall noodles category in Pakistan. In the ketchup segment, competition is being addressed through product innovations, including barbecue flavor, chicken flavor, and green chutney flavor. Additional innovations in this category are also in the pipeline. Raw material sourcing consists of 70% local inputs and 30% imports. The company’s market share in noodles stands at 80%, while for condiments it ranges between 5-8%. Management aims to verify 95% of key crop volumes as sustainably sourced by 2030 and implement regenerative agriculture practices on 1 million hectares of agricultural land by the same year. Looking ahead, management expressed optimism as consumer sentiment remains positive.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.