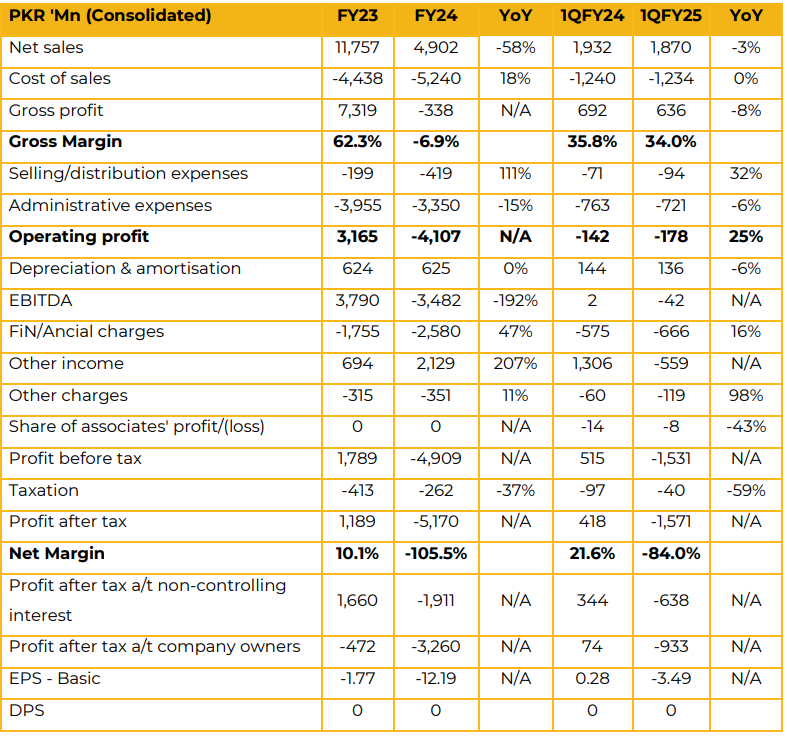

TPL Corp Limited reported consolidated loss per share of PKR 12.19 in FY24 against a loss per share of PKR 1.77 in FY23. Furthermore, in 1QFY25 the company reported consolidated loss per share of PKR 3.49 against earnings per share of PKR 0.28 in SPLY.

In TPL Insurance, despite the economic slowdown, the motor segment saw a year-on-year (YoY) increase of 9%, amounting to 3 billion, while the property segment recorded a YoY rise of 26%, totaling 759 million. The merger with NHIC, a Pakistan branch of AIG Insurance, resulted in a surplus of Rs. 1.078 billion. In TPL Life, gross margins increased by 11%, driven by an 82% rise in the retail segment, though the corporate segment saw a 70% drop, reflecting the company’s strategic pivot toward retail.

TPL Trakker holds a leading 39% market share in the telematics segment and is the only listed company in Pakistan involved in the tracker business. Overall, TPL Trakker’s revenue grew by 15%, with significant growth exceeding four times in the IIOT segment. Trakker Middle East has formed a strategic partnership with Gargash Group, which will inject fresh equity for acquiring a 50.1% stake.

The legal processes were completed in November 2024, and the equity injection is expected by December 2024. In TPL Properties, the Hoshang project is expected to be completed by FY26. Regarding the technology park, they plan to sell the Korangi land due to investor concerns and relocate closer to the mangroves. Negotiations for the sale are ongoing. The technology park land is profitable, and they anticipate an exit soon.

Looking ahead, as interest rates decline, they expect increased vehicle sales, leading to higher profits for the tracker and insurance businesses. Additionally, the company has Rs. 4.5 billion in debt, and a sharp fall in interest rates is expected to positively impact the bottom line.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.