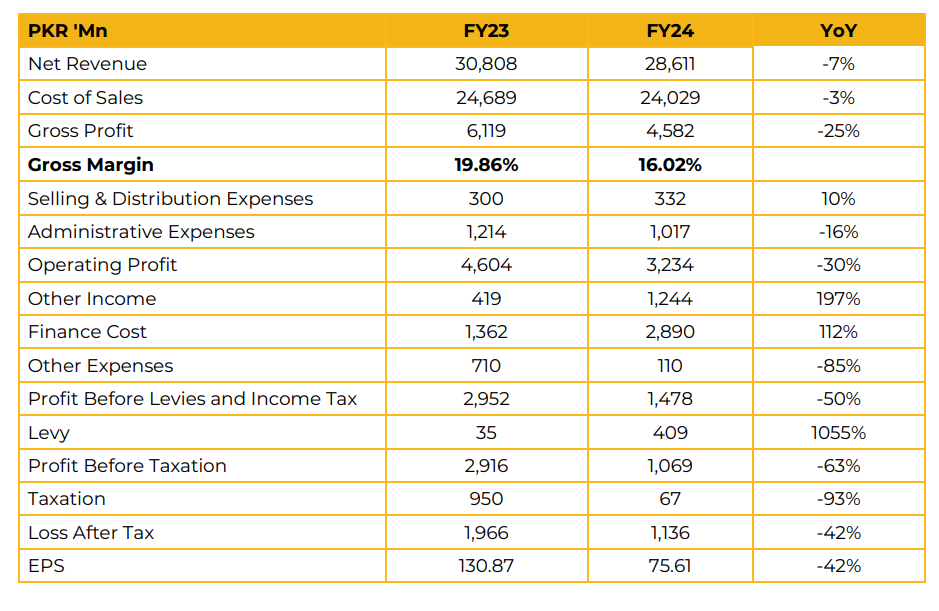

In FY24, The Thal Industries Corporation Limited (TICL) reported a net profit of PKR 1.14 billion (EPS: PKR 75.61), marking a 42% decline from the previous year’s net profit of PKR 1.97 billion (EPS: PKR 130.87). The decline was primarily due to higher financial costs and rising sugarcane prices. In FY24, TICL crushed 2.70 million metric tons of sugarcane, producing 260,000 metric tons of sugar with a recovery rate of 9.65%.

Despite higher crushing volumes, recovery rates declined due to pest and whitefly attacks in Layyah. Gross profit and net profit margins fell to 16.02% and 3.97%, respectively, due to rising financial costs. The revenue mix for FY24 was as follows: sugar contributed 81.60%, molasses 12.02%, electricity 4.75%, bagasse 1.42%, and press mud 0.20%. Overall, revenue declined by 7% YoY to PKR 28.61 billion (FY23: PKR 30.81 billion). Pakistan’s total sugar production in FY24 was 6.8 million tons, with a stock carryover of 0.7 million tons from FY23, bringing total availability to 7.5 million tons. Annual consumption stood at 6.2-6.3 million tons, resulting in a surplus of 1.3 million tons.

Due to this surplus, sugar prices remained under pressure, trading around PKR 115-120 per kg. The sugar industry urged the government to allow 1 million tons of exports, but only 150,000 tons were approved in June 2024. Additional quotas of 100,000 tons in September and 500,000 tons in October were later approved. As a result, the crushing season on November 21, 2024 started with a sugar carryover of 600,000-650,000 tons. Sugar procurement costs increased from PKR 416 per maund in FY24 to PKR 420 in the current year.

The ex-mill sugar price is PKR 140 per kg. The government banned sugar exports when prices hit this threshold. Total assets increased significantly to PKR 27.8 billion, mainly due to higher sugar stock carryover, as the expected production forecast of 6 million tons was surpassed by an actual yield of 6.8 million tons, leading to excess supply. TICL’s Layyah Sugar Mills has a bagasse-based power generation capacity of 45MW, with 20MW sold to Multan Electric Power Supply Company under an IPP agreement.

The Safina Sugar Plant generates 13MW, which is entirely used for internal consumption. Approximately 50% of the company’s total sugar production is sold to the corporate sector, including beverage and pharmaceutical companies, while the remaining 50% is sold to the unregistered sector. Looking ahead, TICL expects sugar production in FY25 to align with last year’s levels. Sugar production is projected at 6.2 million tons with 10% decline, with a carryover of 650,000 tons, bringing total availability to around 7 million tons.

Since the annual consumption is around 6.2-6.4 million tons, company does not foresee a significant surplus in FY25, with an expected excess of only 300,000-500,000 tons, which is considered nominal in the sugar industry. A clearer market picture is expected to emerge after February 2025.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.