Key Takeaways:

Export registrations have been completed in Azerbaijan, Uzbekistan, and GCC countries.

The company is prioritizing the expansion of its product portfolio, emphasizing offerings with higher gross margins.

Their recently launched product, Adalimumab is demonstrating exceptional growth.

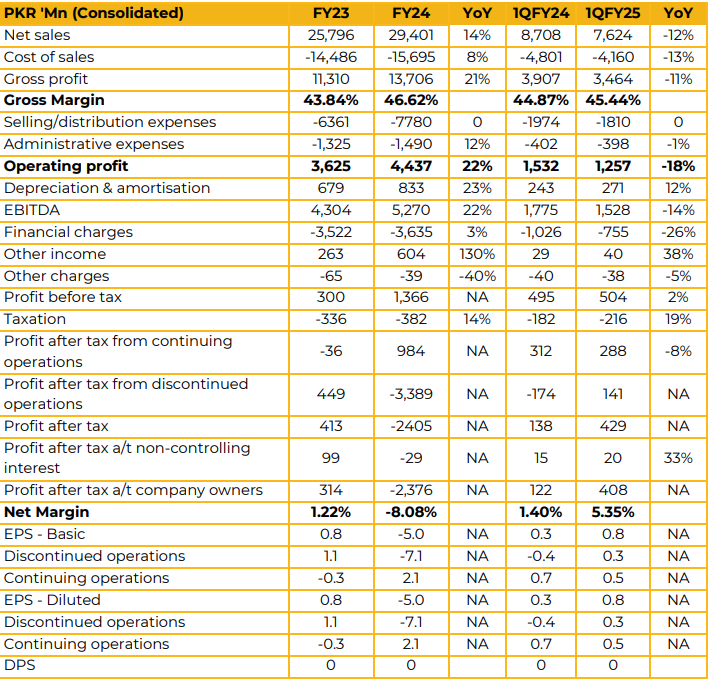

The Searle Company Limited reported consolidated loss per share of PKR 5.0 in FY24 against earnings per share of PKR 0.8 in FY23. Furthermore, in 1QFY25 the company reported earnings per share of PKR 0.8 against PKR 0.3 in SPLY. The company’s current export contribution stands at 11%, and they are actively working to improve it. The portfolio currently consists of 80% non-essential and 20% essential products. Recently, the company has registered in Uzbekistan, Azerbaijan, and the GCC region, with plans to materialize these markets by the end of this quarter. Additionally, the company announced that Searle subsidiary transaction is expected to conclude by December.

Proceeds from this transaction will be utilized to reduce debt, with the remaining amount allocated to support business operations. The company highlighted the strong performance of its recently launched product, Adalimumab, which has shown exceptional progress.

The product is projected to generate annual sales of $250 million, exceeding expectations with margins between 65-80%. Regarding competition, the company noted that Humira sells similar product at significant higher prices so there is currently no competition in the market.

Looking ahead, the company plans to launch locally manufactured monoclonal antibodies similar to Adalimumab within the next 1-1.5 years. In addition, the company is preparing to introduce new products, including Semaglutide and a blood-thinning agent. A team recently visited China to procure the machinery required for Semaglutide production.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.