Key Takeaways:

• Favorable impact of interest rate decline to start from 2QFY25.

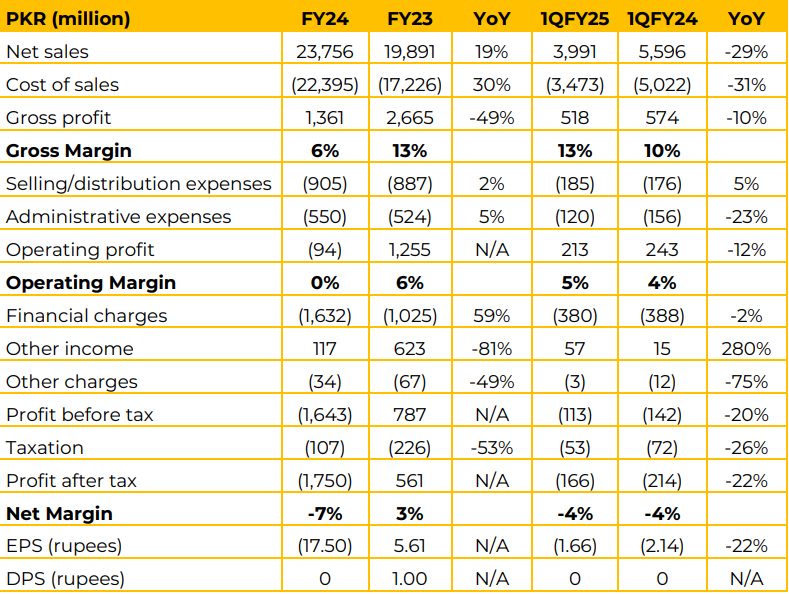

The Company reported FY24 net sales of PKR 23,756 million, reflecting a 19% YoY increase. However, 1QFY25 net sales declined 29% YoY to PKR 3,991 million due to subdued demand and reduced volumes.

The cost of sales surged 30% YoY in FY24, resulting in a gross profit contraction of 49% YoY to PKR 1,361 million. Consequently, the gross margin narrowed to 6% in FY24 compared to 13% in FY23. Similarly, 1QFY25 saw a gross profit decline of 10% YoY, though the gross margin improved to 13% from 10%.

High procurement cost of cloth, yarn and packing materials, processing and weaving charges along with unabated rise in energy prices were the major dampeners in inflating input costs and substantially reduced gross margins during FY24. During 1QFY25, other input cost showed decline except power and depreciation due to higher RLNG prices and Capex incurred on new air jet looms installed at Hattar Industrial Estate in KP. Financial charges surged 59% YoY in FY24 to PKR 1,632 million, driven by higher interest rates and debt levels, pressuring the company’s bottom line. In 1QFY25, financial charges remained relatively stable at PKR 380 million.

Much improvement in this cost may result in 2nd Quarter of FY25 due to effects of two rate cuts announced by SBP during 1st Quarter FY25. . Going forward, the managemnt anticipates an improved operational and financial performance in the coming periods, supported by a stabilizing PKR/USD parity (as they take forward covers) and a gradually recovering economic environment.

The efforts to reduce finance costs, enhance input cost efficiencies through better capacity utilization, and accelerate GST refunds are expected to positively impact profitability. While challenges remain elevated, the company remains committed to delivering sustainable value to stakeholders and achieving its long-term strategic objectives.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.