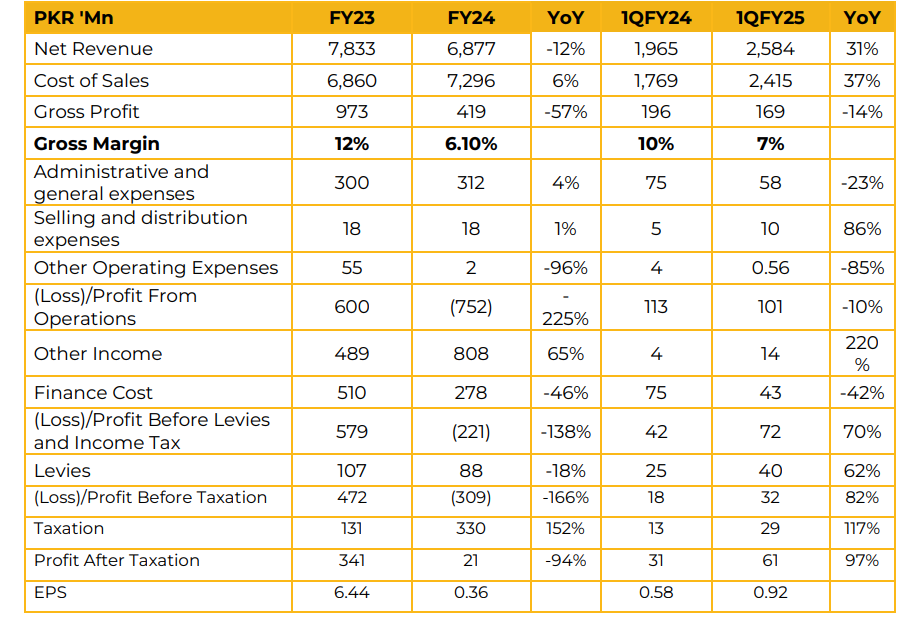

In SY24, TCORP reported a net profit of PKR 21.12 million (EPS: PKR 0.36), marking a 94% decline from PKR 341.05 million (EPS: PKR 6.44) in the previous year.

The decline in profitability was primarily driven by higher operational costs, resulting in a gross loss. Cane procurement costs increased from PKR 400 per maund (subsidized) in the previous year to PKR 470 per maund by year-end.

Additionally, the overall sugar recovery rate declined due to lower yields and the absence of rainfall. In SY24, TCORP reported total cane crushing of 570,050 MT, compared to 616,378 MT in the SPLY. The sugar recovery rate improved to 10.21% in SY24 from 9.76% in SY23, while the molasses recovery rate increased to 5.01% from 4.82% in the previous year. The company’s operational days also increased to 102 in SY24, up from 97 days in the SPLY. TCORP is undergoing an expansion, increasing its crushing capacity from 8,500 TCD to 15,000 TCD.

The total estimated cost of the expansion is PKR 1.5-2 billion, with machinery expenditures ranging between PKR 400-500 million. Civil work has been completed, with 50-60% of the overall expansion finalized.

The remaining 40% is expected to be completed over the next 1-2 years. Looking ahead, cane crushing is expected to remain at 8,500 TCD in 2025, with the current crushing season projected to conclude within the next two to three weeks.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.