Key Takeaways:

• Management anticipates finance cost to reduce, in-line with declining interest rates.

• 50 MW Coal Fired Power Plant expected to be completed by June 2025; expected per unit cost Rs. 26 – 26.5

• Management expects gross margins to increase with the establishment of 50 MW CFPP.

• Company remains market leader in caustic soda; Market Share 48-49%

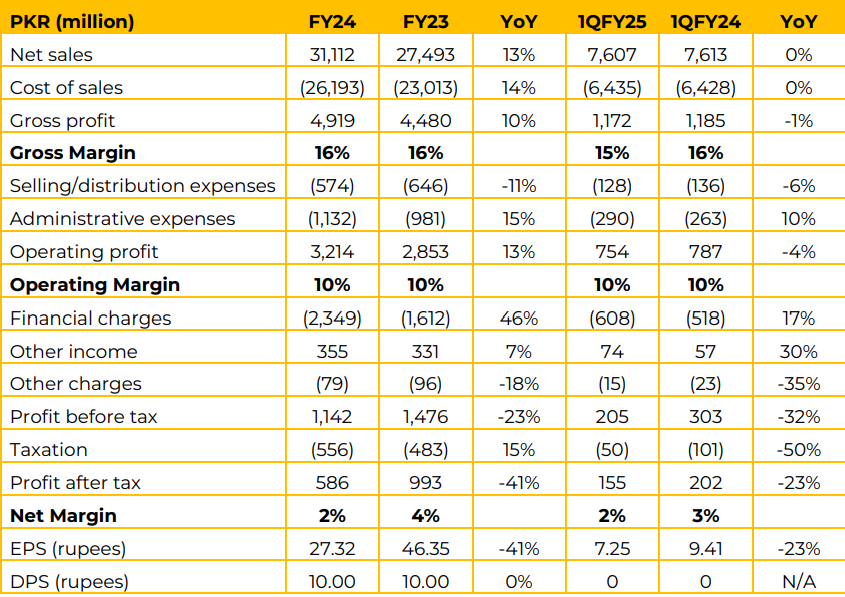

In FY24, net sales increased by 13% YoY, reaching PKR 31,112 million compared to PKR 27,493 million SPLY. In 1QFY25 net sales remained flat at PKR 7,607 million compared to SPLY.

Financial charges in FY24 surged by 46% YoY to PKR 2,349 million, primarily due to higher interest rates and increased borrowing. The company expects that further reduction in policy rate will bring savings in financial cost for the company. Profit after tax dropped by 41% to PKR 586 million (EPS: PKR 27.32) in FY24, resulting in a reduced net margin of 2% (FY23: 4%).

The 50 MW Coal-Fired Power Plant expansion at Sitara Chemical Industries Limited is progressing, with erection activities ongoing. The civil work for the Main Power House and Cooling Towers is set for completion by December 2024. The project is on track for completion by June 2025. Total cost of plant is PKR 10.5 billion. The plant will run on imported coal. (financing: 75% Debt, 25% Equity).

Company currently holds 29 MW gas fired plant and 38 MW coal fired plant. Management noted that they are receiving RLNG supply, however they can easily shift on grid or furnace (Sitara Energy). Coal fired plant currently holds 45% of the power mix, while the remaining 55% comes from WAPDA or Gas whichever seems cheaper.

Total energy requirement of the company remains 55 MW. Moreover, in AGM 2024 the consent of shareholders is accorded to the disposal and sale of the company’s freehold agriculture land located in Faisalabad, comprising of 3302 Kanal, for cash consideration.

Approval has been granted for the utilization of proceeds from the disposal of assets for loan and/or establishment of alternate energy sources as may be approved and recommended by the Board of Directors. Proceeds from previously sold land will be received in March-2025.

Current price of soap noodles is between Rs. 350-400 per kg, with 10-15% margin. The price of caustic soda is around Rs. 155,000 per ton, while that of caustic flakes is around Rs. 225,000 per ton. While discussing the market share of caustic soda in Pakistan, the management told that Sitara Chemicals is market leader in caustic soda with 48-49% market share, followed by Ittehad Chemicals 26-27%, Engro 15% and Nimir Chemicals 7-9%.

The company faces several challenges that could impact its performance and operations. Geo-political risks stemming from instability in the Middle East pose a threat to supply chain continuity and may lead to higher energy costs. Currency depreciation remains a concern, as any further devaluation of the PKR against the US Dollar could escalate import costs, squeezing margins.

Going forward, the company expects recovery in profitability with declining interest rates. Moreover, management also expects some growth in gross margins once the 50 MW CFPP comes online in June-2025. The company also plans to export caustic soda. Management also expects recovery in textile segment with macroeconomic improvement.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.