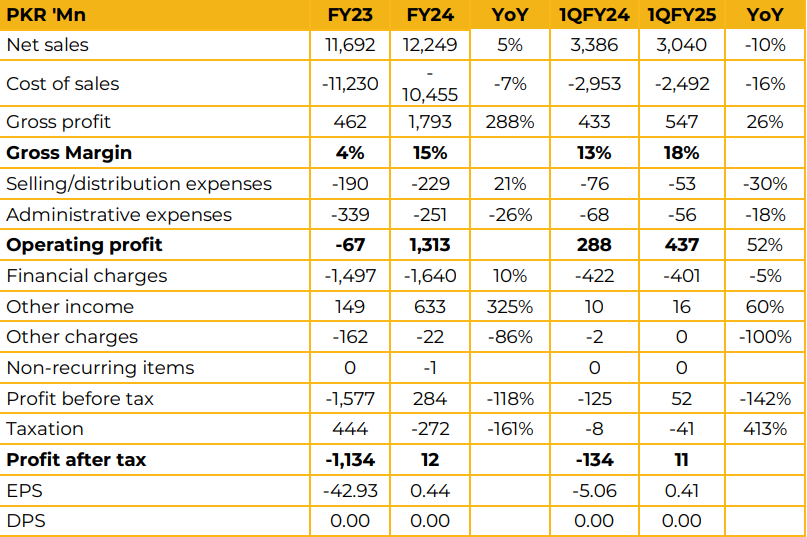

Saif Textile Mills Limited reported earnings per share of PKR 0.44 in FY24 against a loss per share of PKR 42.93 in FY23. Revenue for FY24 was recorded at PKR 12.2 Bn, up 5% compared to PKR 11.7 Bn in FY23.

The company saw its gross margin improve to 15% in FY24 from 4% in FY23. As a result, operating profit surged to PKR 1.3 Bn in FY24 compared to an operating loss of PKR 67 Mn in FY23.

The company currently receives about 40% of its revenue from commodity yarn, 30% from specialized yarn and the remaining 30% from cotton yarn segment. For FY25 the company has set a revenue target of PKR 13-15 Bn. It expects that the declining interest rate environment will lead to improved profitability as well.

The management was of the opinion that it is likely that the suspension of gas supply to captive power plants will be deferred as currently the government is in talks with the IMF to stop this action to prevent PKR 400 Bn loss to the gas distributors.

The company has obtained a stay order against the suspension of gas supply and the next hearing in this regard is on 15th Jan 2024. The company has experienced higher finance costs in recent times due to the need to raise funds to manage working capital requirements. As a result, the sponsor provided a PKR 1 Bn loan to be repaid in 9 years with a 2-year grace period.

A running finance line has also been provided by an associate company of PKR 1.5 Bn. Going forward, the management is working to install a solar plant with 8-9MW capacity with an expected capex of about PKR 900 Mn. It aims to begin this project as soon as possible so that it may benefit from reduced and stable power costs.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.