Key Takeaways:

• Declining interest rates to cut costs and drive growth.

• RSTPL to ensure cost control, raw material supply, and exports.

• Expanding into e-commerce and SMEs alongside top FMCG clients.

• Solar power plant boosts energy efficiency and cuts costs.

• Stable raw material prices to support margins.

• Industry status could unlock export and investment benefits.

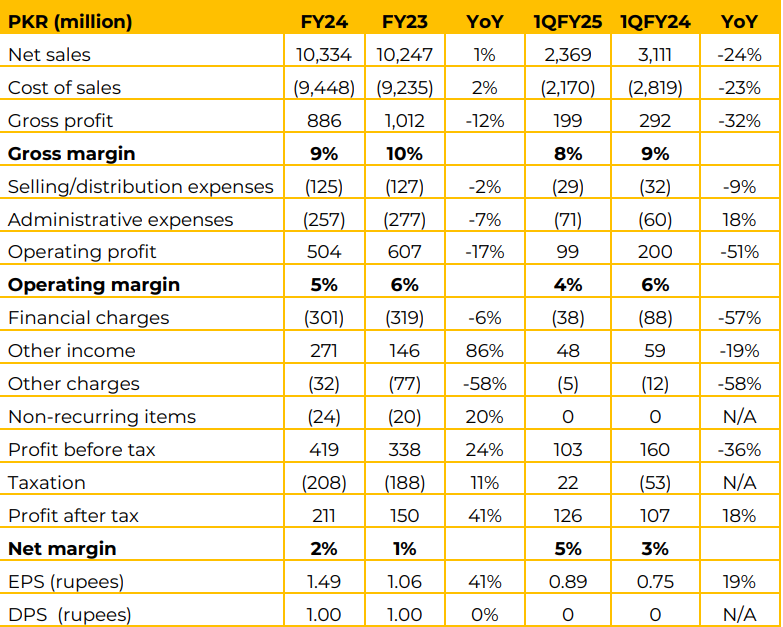

Roshan Packages Limited posted marginal growth of 1% YoY in net sales during FY24, reaching PKR 10,334 million compared to PKR 10,247 million in FY23.

However, the first quarter of FY25 (1QFY25) experienced a significant 24% YoY decline, with net sales at PKR 2,369 million. . Financial charges declined 6% YoY in FY24 to PKR 301 million, due better working capital management despite of higher interest rate.

The company has installed 1.75 MW of solar power plant and its corrugated production line is fully operational through solar power plant. The company is increasing its market penetration through focusing on packaging for ecommerce businesses and SMEs. While, the company stands out through maintaining orders from big FMCG players like Unilever, Nestle, CocaCola, Dalda, Sunridge, Lu, PeakFreans, Abbott, Haier, Pepsi, Imtiaz, Daraz etc

The company also plans to integrate vertically. Roshan Sun Tao Paper Mill Pvt Ltd (RSTPL) – a wholly owned subsidiary is under development and will serve the purpose by manufacturing brown paper for corrugated packaging with a production capacity of 100,000 ton per year.

The company also plans to export the brown paper after meeting its own requirement. Being established in a SEZ, the subsidiary will enjoy 10-year tax break and relaxation on import duties on plant & machinery. Due to sub-sued demand the raw material prices are stable and expected to reduce.

Raw material for corrugated segment is sourced locally, while that of flexible printing is imported. While addressing a question, the management mentioned that if industry status is allotted to packaging companies, the companies will come into mainstream, allowing level playing field, as certain government policies are applicable on industries and it becomes a formal segment of the economy. This helps in the facilitation of exports and investments can be made into the industry.

Going forward, management anticipates a favorable outlook driven by multiple positive factors. Declining interest rates are expected to reduce financing costs and create opportunities for expansion. Stabilization in inflation rates is projected to support growth in the packaging sector.

Demand from key sectors, including FMCG, pharmaceuticals, and textiles, is expected to rise, leading to higher order volumes. Recovery in consumer spending is anticipated to boost overall demand, further strengthening the company’s growth trajectory

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.