Key Takeaways:

• The company has initiated an LC for the installation of a 9MW solar project, with another LC for 6MW currently in process. Together, these projects are expected to produce 23 million units, potentially resulting in annual savings of Rs 805 million.

• Given the current outlook, the KIBOR rate is anticipated to decline by up to 5% by the end of 2024, which could lead to annual finance cost savings of Rs 787 million.

• The installation of 8 new frames is expected to significantly impact cost efficiency. In Unit-6, adding four frames with 1,008 spindles each is projected to reduce CPS by Rs 2.88. Similarly, enhancements in Unit-3, with four additional frames of 1,008 spindles, are estimated to yield annual savings of Rs 167 million.

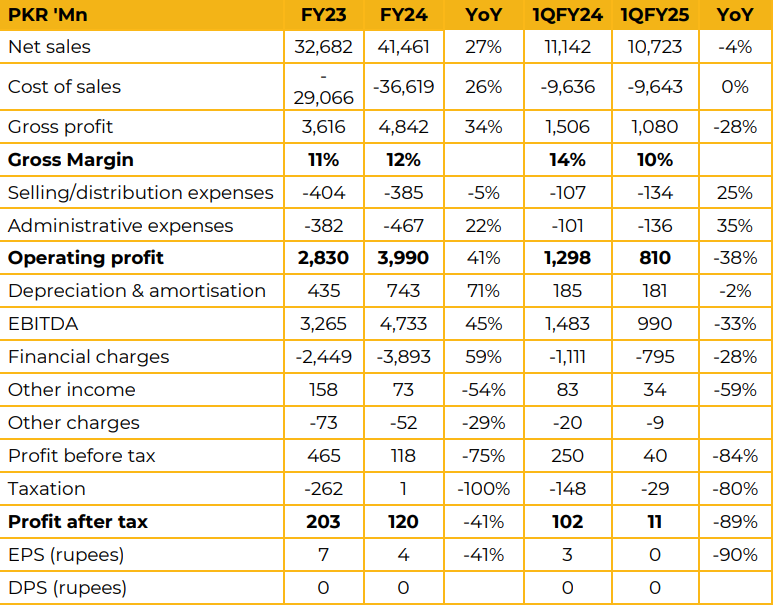

Reliance Weaving Company Limited reported earnings per share of PKR3.88inFY24 against anearningsper shareof PKR 6.59inFY23. Furthermore, in 1QFY25 the company reported earnings per share of PKR 0.34 against PKR 3.33 in SPLY. The company currently operates 91,296 spinning spindles with a production capacity of 28,266 tons. In weaving, it has 482 looms capable of producing 126.5 million meters annually.

The company is facing several key challenges, including reduced demand from European and U.S. markets, low domestic cotton production, and high markup rates. The company’s annual consumption amounts to 145 million units, enabling a production capacity of 35 billion units. The company’s exports include 13 million units in direct exports and 10 million units in indirect exports.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.