Key Takeaways:

• The company has plans for expansion and is designing a blueprint that will be implemented once economic conditions stabilize.

• Efforts are underway to increase local coal consumption to 90%, aligning with the company’s resource optimization strategy.

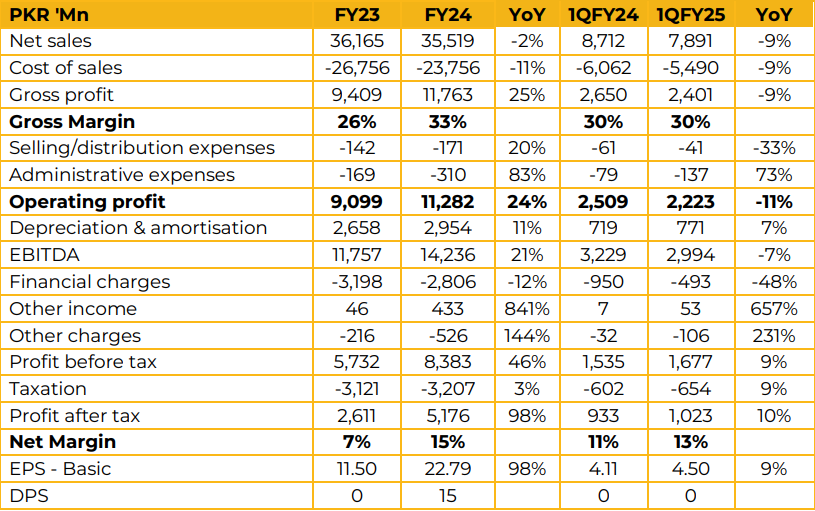

Pioneer Cement limited reported earnings per share of PKR 22.79 in FY24 against an earnings per share of PKR 11.50 in FY23. Furthermore, in 1QFY25 the company reported earnings per share of PKR 4.50 against PKR 4.11 in SPLY. The company recorded increase in gross margins that stood at 33% as compared to 26% in FY23.

Since their debt was it manageable level they were able to pay record dividends of 15rs in FY24 The company has significantly optimized its fuel mix by increasing the use of local coal from 51% to 75% in FY24, with plans to further elevate this proportion to 90%. Net retention for the period stands at rs16,594 though it has been negatively impacted by higher royalty costs, with a differential of approximately rs1,000 per ton compared to players in the KPK region. The company experienced a decline in market share during the current year, primarily due to capacity expansions by competitors. In terms of energy strategy, the company does not intend to invest in solar power. Instead, future expansion plans will leverage local or Afghan coal resources.

Additionally, they have a desulfurization unit in place to manage emissions effectively. Financially, the company maintains a robust liquidity position, which it is actively using to reduce debt. Expansion initiatives include brownfield projects and potential developments in Khushab, D.G. Khan, and D.I. Khan over a span of 7 years however, these are contingent on the stabilization of economic conditions. Looking ahead, the company is developing a blueprint for a highly efficient plant, which aims to outperform existing facilities in the country The immediate focus remains on debt reduction and expansion. Once the priority task gets settled, they will try to compensate their shareholders.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.