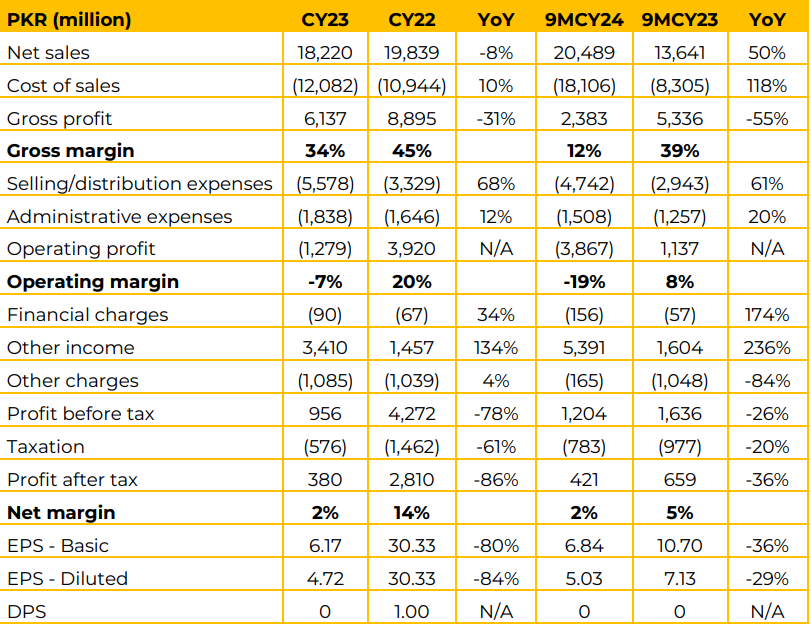

Philip Morris Pakistan reported a YoY decline of 8% in CY23 net sales, dropping to PKR 18.2 billion from PKR 19.8 billion in CY22. However, the 9MCY24 net sales grew significantly by 50% YoY to PKR 20.5 billion. The gross margin dropped to 34% in CY23 from 45% in CY22.

The 9MCY24 gross profit saw an even sharper decline of 55% YoY, with the gross margin shrinking to 12% from 39%. The company attributes this decline to supply shock in tobacco production and high import cost of nicotine pouches.

Profit after tax (PAT) plummeted 86% YoY in CY23 to PKR 380 million, as the net margin dropped to a mere 2% compared to 14% in CY22. On a nine-month basis, PAT declined by 36% YoY to PKR 421 million. Basic EPS dropped to PKR 6.17 in CY23, a steep fall from PKR 30.33 in CY22.

The government has imposed high excise duties on tobacco products, which has caused price increase for the legitimate products. However, the illicit gets the competitive advantage of selling their products at competitive rates, thereby impacting the volumes of the formal sector.

The government has introduced Advance Excise duty on raw materials for cigarette such as Acetate Tow & Filter Rods. This move was supposed to create working capital challenges for the illicit manufacturers and enhance the tracking oversight. However, the formal sector also has to lock their cashflows and the desired impact of this duty is yet to be witnessed. The management highlighted that tobacco production has been impacted globally due to climate change.

Whereas, Pakistan’s tobacco production remained competitive in terms of price and quality. The company is focusing to benefit from this arbitrage for a sustainable period of time. In order to optimize the cost and product portfolio, the company is establishing local production facility for new variants of nicotine pouches in Sahiwal.

Going forward, the management expects sustainable implementation measures such as Track & Trace system by the government to curb the trade of illicit & non-tax paid products, which accounts for more than 50% of the market share.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.