Key Takeaways:

• Monetary easing to support profitability through reduced finance costs.

• Expansion to yield higher sales of more sophisticated products.

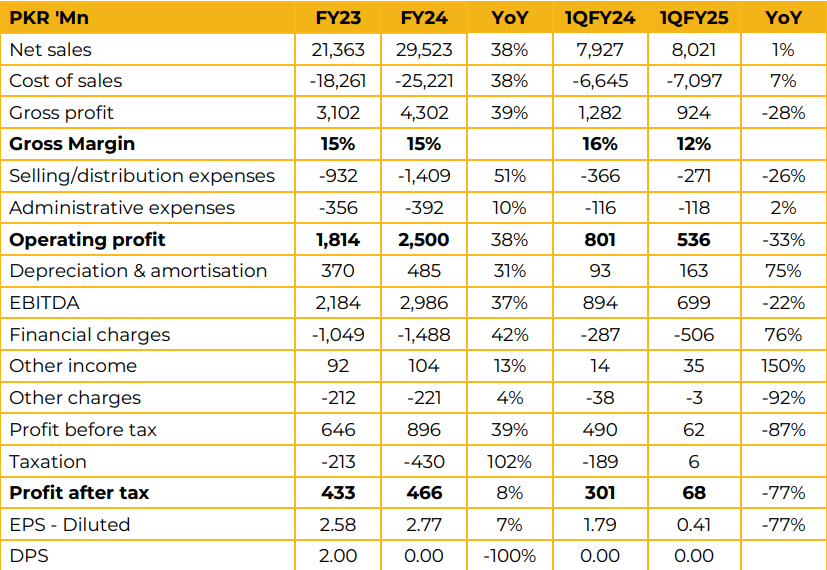

Panther Tyres Limited reported earnings per share of PKR 2.77 in FY24 against earnings per share of PKR 2.58 in FY23, an increase of 7% Total revenue in FY24 reached PKR 29.5 Bn against PKR 21.3 Bn in FY23, an increase of 38%. The company saw its gross margins remain stable at 15% in both FY24 and FY23. In recent months raw material prices had risen causing margins to be squeezed.

However, the company uses the weighted average cost of raw materials in its accounting which means that the company does not expect margins to drop further. Additionally, further softening of raw material prices will allow margins to recover.

The company’s revenue mix by segment is as follows:

1. Replacement Market: 70%

2. Exports: 15% 3. OEMs: 15%

Panther Tyres has also made efforts to localize its supply chain with 55-60% of raw materials now sourced locally compared to 70-75% before. Power usage for the company is based off two sources; WAPDA supply of 11 MW and a 8 MW gas power plant which is also used to produce steam.

The company favors usage of the gas cogeneration plant due to its cost efficiency and does not expect supply to be cut off due to the usage of it in the production process. Management apprised that its expansion of PKR 7 Bn was on top of the existing 6 Bn PPE and now the company does not expect any major capex requirement for 3-5 years. Any expense will now only be on the front end to increase capacity.

The expansion involved civil work which was designed around manufacturers recommendations for the machinery. Management expects the production of more sophisticated products to increase as a result. The new mixing machine is now operational along with the calendaring machine.

Further work in process of PKR 2 Bn is remaining. Sales mix by product category is 40% large tyres and 60% small tyres. The management revealed that tyres were no longer coming in through the Afghan transit trade however smuggling and under invoicing is still present.

However, the company only expects this to impact competition in about 15% of its revenues. The nature of the demand for tyres is seasonal with sales reducing in the winter quarters. As such, producers in the industry continue production so that inventory is on hand for the summers with large production variations not needed.

Going forward, the management expects capacity utilization to pick up and profitability to increase as finance costs go down. The company also hopes to resume dividends once the cash flow situation improves.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.