Key Takeaways:

• PRL’s $1.5 billion REUP aims to double capacity, eliminate HSFO, and produce EURO V-compliant fuels, positioning it for long-term growth.

• Refining policy offers duty incentives and long-term tax benefits, supporting project viability and profitability through 2030 and beyond.

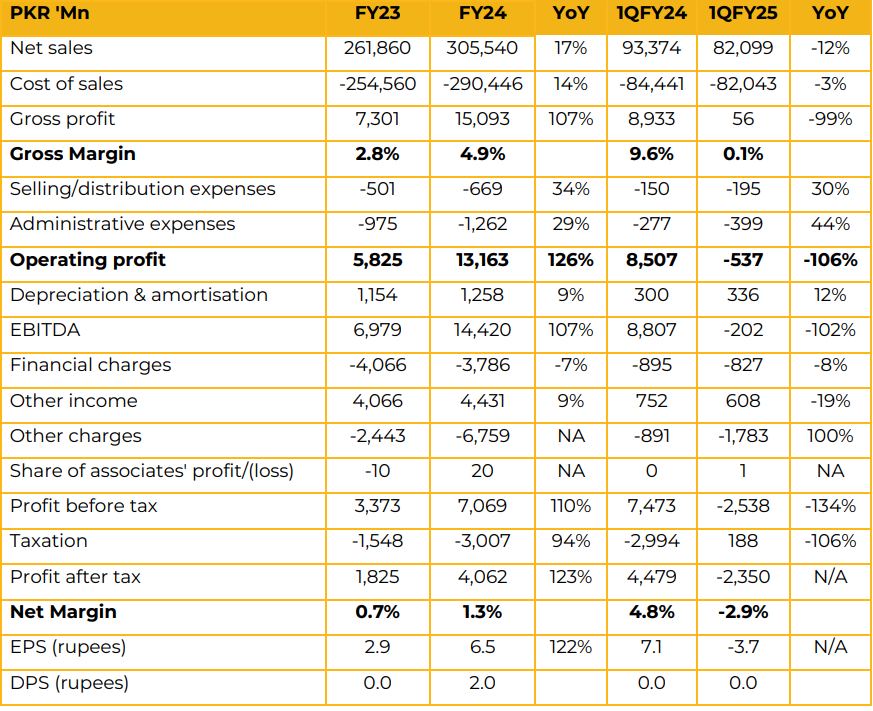

The Pakistan Refinery Limited reported earnings per share of PKR 6.5 in FY24 against an earnings per share of PKR 2.9 in FY23. Furthermore, in 1QFY25 the company reported loss per share of PKR 3.7 against earnings per share of PKR 7.1 in SPLY. 1QFY25 witnessed depressed global refining margins with a sharp decline in the prices of crude oil and petroleum products. The countrywide demand of refined petroleum products mainly Diesel and Furnace Oil showed volumetric decline as compared to the corresponding quarter.

Through Finance Act 2024, the Government of Pakistan designated Motor Spirit, High Speed Diesel, Light Diesel Oil and Kerosene as exempt supplies making the Company unable to adjust input tax paid on purchases from its Sales Tax liability. The company has continued its efforts on the Refinery Expansion and Upgrade Project (REUP) with an estimated total cost of $1.5 billion.

The objectives include ensuring compliance with the production of EURO V compliant High-Speed Diesel (HSD) and Motor Spirit (MS), doubling the crude oil processing capacity from 50,000 to 100,000 barrels per day, and transitioning from a hydroskimming refinery to a deep conversion refinery.

The Front-End Engineering Design (FEED) study has been completed. The Refinery has now initiated the Engineering, Procurement, Construction and Finance (EPCF) tendering process to be followed by Financial Close, in which regard PRL continues to be engaged with different potential strategic investors. Currently, 41% of output is low-value HSFO, which will be eliminated post-upgrade, while higher-value products like HSD and Gasoline will increase to 45% and 34%, respectively. The upgrade will also introduce Propylene (4%), enhancing overall product value and efficiency in line with market demand.

Refining Policy Incentives:

• 10% duty incentive through Motor Spirit (Petrol) pricing.

• 2.5% duty incentive through High-Speed Diesel pricing.

• Incentives are available for 7 years (up to November 2030 for PRL).

• Gross incentives are capped at 27.5% of the project cost for new units.

• 7.5% deemed duty will continue for 20 years post-project completion.

• Incentives will be deposited in an Escrow Account jointly operated with OGRA.

• Utilization of incentives will commence after the Final Investment Decision.

Going forward, the management believes that EVs adoption will only reduce the petrol import, however the local production will remain intact. They also believe that Pakistan’s reliance on petrol will remain for 30 years. Moreover, PRL’s ongoing developments are set to enhance profitability by improving product margins, reducing reliance on low-value HSFO, and capitalizing on policy incentives.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.