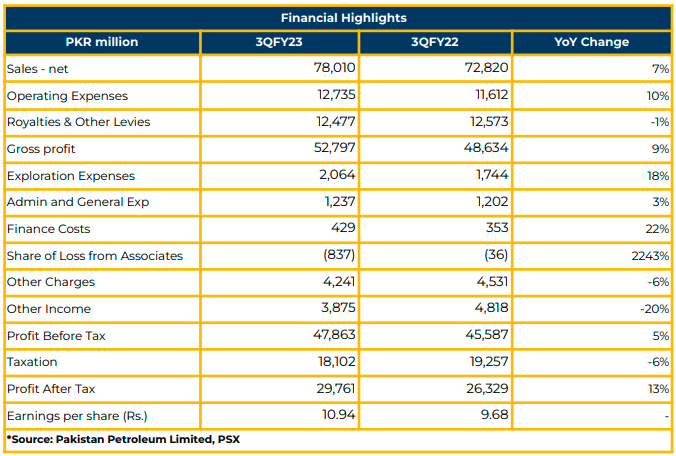

In 3QCY23, Pakistan Petroleum Limited recorded a net profitability of PKR 29.76 billion (EPS: PKR 10.94), indicating a 13% YoY increase from PKR 26.33 billion (EPS: PKR 9.68) in the corresponding period of the previous year.

The company’s topline grew by 7% YoY, reaching PKR 78.01 billion, with a gross profit increase of 9% amounting to PKR 52.79 billion. This upswing in revenue during 3QCY23 was primarily attributed to price increases.

Operating expenses and exploration expenses increased by 10% YoY and 18% YoY to PKR 12.74 billion and PKR 2.06 billion, respectively, in 3QCY23.

The finance cost of the company rose by 22% YoY to PKR 429.35 million in 3QCY23, compared to PKR 352.64 million in SPLY, due to higher interest rates.

Other income and other charges declined by 20% YoY and 6% YoY to PKR 3.88 billion and PKR 4.24 billion, respectively, in 3QCY23.

In FY23, the authorized capital of the company reached PKR 35 billion. The majority ownership, comprising 67.5%, rests with the Government of Pakistan, with an additional 7.4% held by the PPL Employees Empowerment Trust, while the remaining 25.1% is under the ownership of other entities.

As of June 30, 2023, PPL operated 22 producing fields and 45 exploratory fields. Local production experienced a downward trend (3.3Bcfd), PPL constituted 22% of the local production (0.73Bcfd). Similarly, domestic oil supply comprises 27% of total oil supply, with PPL’s share being 17% of local production.

Pakistan’s energy mix consists of oil (25%), gas (29%), coal (14%), hydro (11%), LNG import (10%), nuclear (7%), renewables (2%), and LPG (1%).

PPL made four discoveries and was awarded three exploration blocks in FY23. PPL has finalized a transaction to enter the Reko Diq project, acquiring indirect interest.

In FY23, PPL operated three exploratory wells (One PPL operated and two partner operated) and five development wells (Three PPL operated and two partner operated).

The production was reported at 815 mmscfd in FY23. The field-wise production of gas was reported as follows: Sui (41%), Kandhkot (22%), Adhi (2%), Gambat South (12%), and partner operated & others (23%) in FY23. The share of Kandhkot increased due to higher offtakes in FY23.

The field-wise production of oil was reported as follows: Adhi (20%), Tal (34%), Nashpa (28%), Dhok Suktan (10%), and others (8%).

The revenue mix of PPL comprises of gas (63%), oil (30%), and LPG & others (7%). In FY23, PPL achieved the highest net sales of PKR 286 billion, 42% YoY higher than the previous year due to positive price variance and impact of exchange rate devaluation.

The Company paid PKR 68 billion in income tax due to higher profitability and the imposition of super tax. PPL has submitted requests to the Government of Pakistan for payments of royalties and sales taxes on a receipt basis.

In FY23, PPL achieved the highest profit before tax of PKR 166 billion and increased production despite the majority of production coming from mature fields. In the non-E&P segment, PPL was able to generate the highest-ever sales of Barite.

The receivables from Sui Companies amounted to PKR 513 billion, expected to decrease after the approval of revised gas prices. The receivables of Pakistan Petroleum are: SNGPL (49%), SSGCL (47%), GENCO II (1%), and Others (3%).

In FY23, PPL collected 32% (PKR 74 billion) receivables against gas net sales of PKR 235 billion. However, PPL managed to collect 99% receivables from Oil/LPG companies.

To mitigate the circular debt, the Company is actively working with the government and expects the recent consumer gas price revisions to improve the receivables of the Company. Moreover, PPL aims to target oil resources and overseas operations while exploring opportunities to allocate gas to alternate consumers. PPL is working on Reko Diq and Barite, Lead and Zinc (BLZ) projects to diversify the portfolio and reduce the circular debt.

The well site construction of Adhi water disposal has been completed. The mechanical completion of the Gambat South project is expected to be completed in

PPL expects the drilling of exploration and appraisal wells in 3QCY24 at Offshore Block V in Abu Dhabi. The benchmark for average decline rate of a production well is 8-10% and PPL’s production wells are aging and will lose production completely if Company does not explore other options, as highlighted by the management.

Management highlighted two key challenges for shale gas and tight oil in Pakistan: the role of policies in Pakistan and the capital-intensive technology required to explore these opportunities.

PPL shared that they are recording a 10% lease extension bonus on the well price on Sui D&P lease which will be paid to the Government of Balochistan and Pakistan.

Going forward, PPL anticipates a production forecast of 0.8 Bcfde. During the year, PPL plans to drill nine exploration wells and five development wells while working on seismic campaigns of 1,377 km 2D and 50 sq km 3D acquisition. The Capex for FY24 is estimated at PKR 36 billion.

Due to expected increase in receivables from the SNGPL and SSGCL as a result of revised gas prices, the managemnet anticipates improvement in cash dividend payout also.

Furthermore, PPL is expected to initiate exploration activities in shallow water rather than deep water towards the end of this year or in the coming year, as deep-water exploration demands higher capital investment.

Important Disclosures

Disclaimer:This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.