Key Takeaways:

• Margins to remain stable going forward.

• Not chasing competition anymore in exercise books. The focus is on institutional sales to key customers like TCF, City School etc.

• Sourcing cheaper material to off-set the regulatory duty impact on self-adhesive paper.

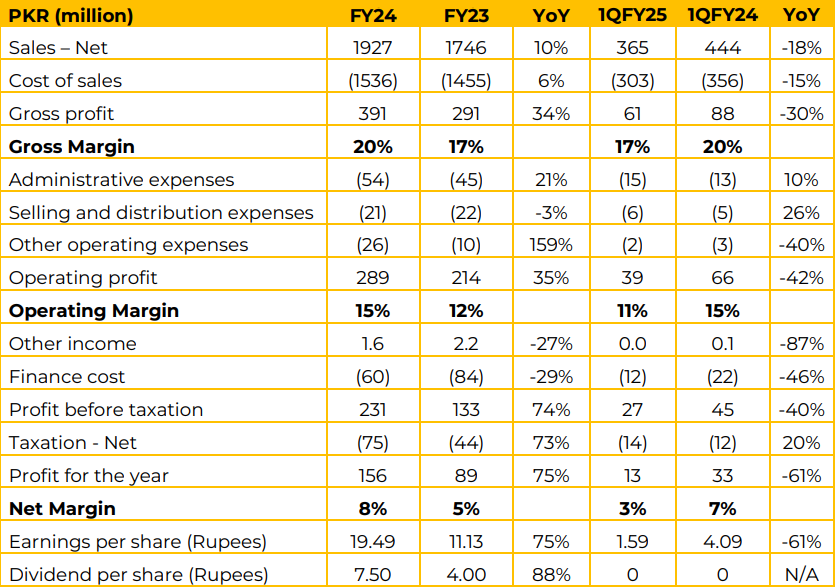

For FY24, the company reported a 10% YoY increase in net sales, reaching PKR 1,927 million. Institutional demand significantly contributed, as the company remains the only recognized player in the formal sector for exercise books. However, 1QFY25 results showed a contrasting picture, with net sales declining 18% YoY to PKR 365 million.

Exercise books were the main contributor to this decline, largely due to aggressive sales in June ahead of the anticipated removal of Zero Rating and the imposition of sales tax in the Finance Bill, coupled with increased competition from the unorganized sector, driven by lower international pulp prices and cheaper paper availability.

In FY24, gross profit surged by 34% YoY to PKR 391 million, with an improved gross margin of 20% versus 17% last year. However, in 1QFY25, gross profit dropped by 30% YoY to PKR 61 million, with margin depressing to 17% from 20% in SPLY. The reduction in margins was mainly due to competitive pricing in exercise books segment and impact of 15% regulatory duty on self-adhesive paper.

The finance cost for FY24 decreased by 29% YoY to PKR 60 million, primarily due to the reversal of exchange losses into a minor exchange gain and a decline in interest rates during the year. Similarly, in 1QFY25, finance costs dropped significantly by 46% YoY to PKR 12 million, reflecting the same factors.

The profit after tax (PAT) for FY24 rose by 75% YoY to PKR 156 million, with EPS increasing to PKR 19.49 due to higher margins and lower finance costs. In contrast, 1QFY25 saw a 61% YoY drop in PAT to PKR 13 million, with EPS declining to PKR 1.59. While the challenge remains in the exercise book segment, the company is also facing competition from other players in the pro-label segment.

Another challenge is passing on the regulatory duty impact. The company wants to honor its commitments to the customers and trying to optimize the impact of regulatory duties by seeking cheaper vendors, keeping costs under control, and maintaining profitability.

In the Pro Labels segment, efforts to improve internal efficiencies, maintain high-quality standards, and leverage stable exchange rates are expected to sustain margins, even as competition intensifies.

Similarly, in the Exercise Books segment, the company plans to capitalize on strong institutional demand and the retention of its Sales Tax Zero Rating, which provides a competitive edge against the informal sector. Going forward, the management expects margins to remain stable at the current levels due to challenging circumstances.

Moreover, the Board has approved a modernization plan to invest in LED UV technology, which reduces energy consumption by over 50%, and advanced rewinding and slitting systems in Pro Labels to boost efficiency and production.

In Exercise Books, rising demand will be met through upgrades like a fully automated flexo ruling machine and a cutting-edge Hot Melt binding machine. These investments aim to enhance quality, improve efficiency, and drive sustained growth.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.