Key Takeaways:

• Increasing gross margins are being utilized to reduce long-term debt.

• Successfully commissioned an ASU plant with a capacity of 270 TPD.

• Launched new products in the medical equipment segment.

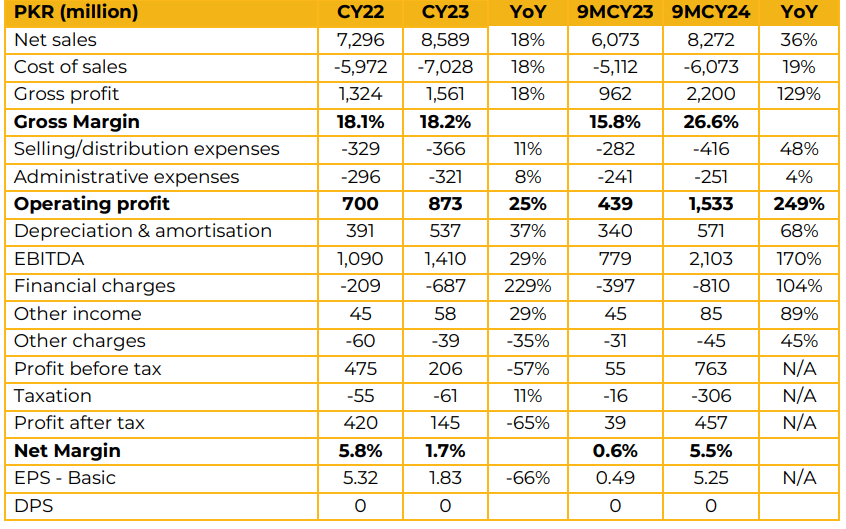

Pakistan Oxygen Limited reported earnings per share of PKR 1.83 in FY23 against an earnings per share of PKR 5.32 in FY22. Furthermore, in 9MCY24 the company reported earnings per share of PKR 5.25 against PKR 0.49 in SPLY.

The company has successfully commissioned the largest ASU plant with a capacity of 270 TPD, along with an 11 TPS electrode facility at Port Qasim.

They have acquired the ASU plant from Linde AG, which offers high efficiency, positively impacting the company’s profitability. In the welding business, the company is focusing on Tier 1 electrodes, a segment where they enjoy higher profit margins. In medical engineering services, the company has delivered several projects this year, the most notable being the commissioning of a medical gas pipeline system for the 600-bed Indus Hospital. In recent quarters, the company has achieved higher margins, which are being used to pay off long-term debt and enhance balance sheet stability. For medical gases, the company anticipates stable demand from the healthcare and beverage industries.

Company is Currently operating at 70% capacity utilization; they had earlier acquired machinery to meet growing demand. Additionally, they are the sole producer of hydrogen in the market, supplying primarily to the textile sector.

New products in medical engineering and welding generated revenue of 130 million. In the medical equipment segment, the company has launched bedhead units and initiated the import substitution of operating theatre equipment. They have introduced ten product ranges to the market, receiving positive response. Moving forward this segment is a key focus area, given its high value and strong profit margins.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.