Key Takeaways:

• PNSC plans to replace 4 Aframax tankers, with expected deliveries starting from 2027.

• Tanker demand to rise with refinery shifts, but geopolitical risks remain.

• PNSC revising Procurement Policy to allow secondhand vessel purchases.

• LR1 earnings improved to $15,000/day; cargo demand expected to grow with government tenders.

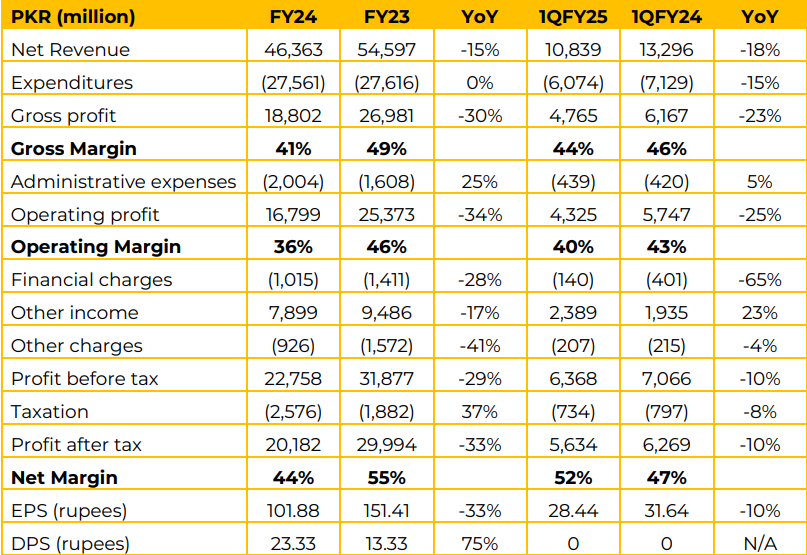

In FY24, net revenue witnessed a decline of 15% YoY to remain PKR 46.3 billion. PNSC chartered ships for Trading Corporation of Pakistan in FY23, while the charter income remained low in FY24. Moreover, 3 tankers were drydocked, thereby impacting the revenues.

However, these tankers are back in service. Financial charges decline by 28% YoY in FY24, mainly due to repayment of loans. Profit after tax declined by 33% to PKR 22.7 billion in FY24, due to the effect of income from non-recurring items in FY23. “Karachi-vessel” completed its useful life and was sold yielding a gain of PKR 3.3 billion in FY23.

Moreover, the company also earned exchange gain of PKR 3.2 billion in FY23. As per the requirement of International Maritime Organization, the shipping fleet must be decarbonized and made greener by 2030. PNSC operating internationally has to comply with the standard, has now therefore decided to modernize its fleet. 4 out of 5 Aframax tankers are about be replaced with the newer ones. Bids were received against the tender; discussions are ongoing with the bidders. Hoping to sign a contract by the end of calendar year 2024. Older vessel if sold in the running condition would have a value of $12-15 million.

However, the scrap value would be $7-7.5 million. The resale value of new vessel would cost $85 million. New building vessel would cost $73.25 million. However, secondhand 5-year-old and 10-year-old vessel would cost $60.00 million and $72.50 million respectively. PNSC would go for a new one or 5-year-old vessel. Currently, PNSC is restricted from procurement of secondhand,

However, under the provisions of StateOwned Enterprises Act 2023., Corporation is allowed to formulate its own Procurement Policy in line with international shipping industry practices. PNSC’s Procurement Policy is under review to be submitted for the approval of Federal Government.

The management mentioned that going forward there is going to be 60,000 – 65,000 vessels replaced internationally in compliance with 2030 goal of green shipping.

Therefore, it would be rational to procure the new fleet earlier. If a new building contract is signed today, delivery will be expected by 2028. First delivery for PNSC is expected by 2027. PNSC handles 8 million tons of cargo for refinery. LR-1 tankers earnings have been improved from $14,000 a day to $15,000 a day.

Management expects demand and freight rates to improve, as winter filters down in the West from January 2025. On the clean and dry bulks side, management anticipates major improvement. LCL, FCL and break-bulk movement is expected to increase, as government has awarded many tenders.

Current time-charter on aframaxes is $30,000 -$35,000 pe day, $10,000 – $15,000 per day for LR-1 and for bulk carrier its $11,000 per day. PNSC maximizes profits through tailored strategies across its fleet. Aframaxes operate on a mix of spot voyages and COAs, ensuring minimal idle time while fulfilling crude oil transport obligations.

LR1 tankers focus on short-haul spot voyages to leverage cyclical market trends, avoiding longhaul commitments. Bulk carriers, constrained by age and trading limits, are fixed on TCT and TC contracts for stable cash flows. For liner and break-bulk cargoes, PNSC uses MLOs for FCL/LCL bookings based on seasonal trends, while break-bulk cargoes are arranged on FLT/CQD terms with spot chartering for flexibility.

With regards to a question regarding cargo handling for Reko Diq, the management noted that Reko Diq Mining Company has not reached-out directly, but one of the Chinese firms who secured mining license from Govt. of Baluchistan reached out and had 2-3 meeting with them.

The company is open to any such contract on market competitive terms. Going forward, the market outlook for the tanker industry remains broadly positive over the next three years, driven by strong demand trends and limited tonnage supply growth.

Refinery closures in Europe and the addition of 3.5 million b/d of refining capacity in the Middle East, India, and China are reshaping trade patterns, supporting freight rates.

However, Chinese shipyards prioritizing container vessels, LNG carriers, and strategic imports may limit additional product tanker orders beyond 2028. Despite these positives, geopolitical instability continues to pose risks, and a resolution of disruptions in the Red Sea could significantly reduce tonne-mile expansion, potentially reversing the current trend by 2025.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose