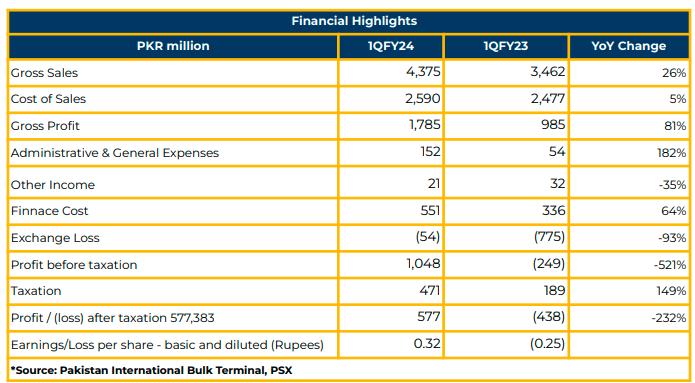

In the 1QFY24, Pakistan International Bulk Terminal (PIBTL) reported a net profit of PKR 577.38 million (EPS: PKR 0.32), marking a significant improvement from the net loss of PKR 437.90 million (LPS: PKR 0.25) in the corresponding period of the previous year.

The net revenue rose by 26% YoY to PKR 4.37 billion in 1QFY24, compared to PKR 3.46 billion in the same period last year. However, volumes decreased by 50% due to considerable devaluation, inflation, higher interest rates, and import restrictions.

The gross profit showed an 81% YoY increase to PKR 1.78 billion in 1QFY24, up from PKR 984.70 million in the same period last year. Despite a rise in coal commodity prices, Afghan coal adversely impacted the company’s import volumes. Notwithstanding these challenges, operational efficiencies improved the company’s margins.

In FY23, PIBTL handled 41% fewer coal volumes, totaling 4.8 million tons, with a revenue of PKR 9.07 billion—a 14% YoY decline. EBITDA also witnessed a 29% YoY drop to PKR 3.06 billion in 1QFY24.

Cost of services increased by 5% YoY to PKR 2.59 billion in 1QFY24, compared to PKR 2.48 billion in the same period last year. Similarly, finance costs rose by 64% YoY to PKR 550.85 million, while other income declined by 35% YoY to PKR 20.50 million in 1QFY24.

The company’s finance costs doubled to PKR 2 billion in FY23, up from PKR 1.1 billion in the previous fiscal year, attributed to higher interest costs and inflation. Currency devaluation also impacted USD-denominated foreign loans, reaching PKR 2.3 billion compared to PKR 1.6 billion in the same period last year.

In FY23, the company handled 4.8 million tons across 86 vessels, down from 8.24 million tons and 146 vessels in the previous fiscal year. Volumes for the cement sector decreased, while those for the power sector significantly increased: Power 2.4 million tons (50%), Cement 1.2 million tons (24%), Trader 0.9 million tons (19%), Chemical 0.17 million tons (4%), and Textile 0.13 million tons (3%) in FY23.

The current capacity for handling volumes is 12 million tons of coal and 4 million tons of cement & clinker per year. Management indicates the potential to increase total capacity up to 20 million tons per year.

Total investment in PIBTL amounts to USD 300 million, with a concession period of 30 years BOT extendable. The current concession period is expected to conclude by 2046, with negotiations likely to start by 2040 for the agreement’s renewal with the government. PIBTL allocates 35% of its revenue to the Port Qasim Authority as royalty.

The shareholding structure includes Associated Companies (43.30%), Directors, CEOs, and their spouses & children (12.80%), Mutual Funds & Modarabas (1.42%), Foreign entities (0.52%), and others (41.96%). Regarding the substitution of imported coal with Thar coal, the company still aims to import coal for its operations and expects the export of Thar coal after meeting local demand in the future.

Going forward, the terminal company anticipates an increase in demand for imported coal, particularly from the power sector, due to the elimination of import restrictions and stability of the Pakistani rupee against the USD. For the next couple of years, PIBTL expects a demand trend of around 7-8 million tons. Concerning debt, the company plans to pay off debt and subsequently distribute dividends to shareholders.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.