Key Takeaways:

• The company expects this trend to continue in the coming years.

• introduce a new product vehicle top-up financing set to launch in the market for the first time.

• The management anticipates a favorable outcome in the ongoing case regarding the sale of OPP Pvt Ltd.

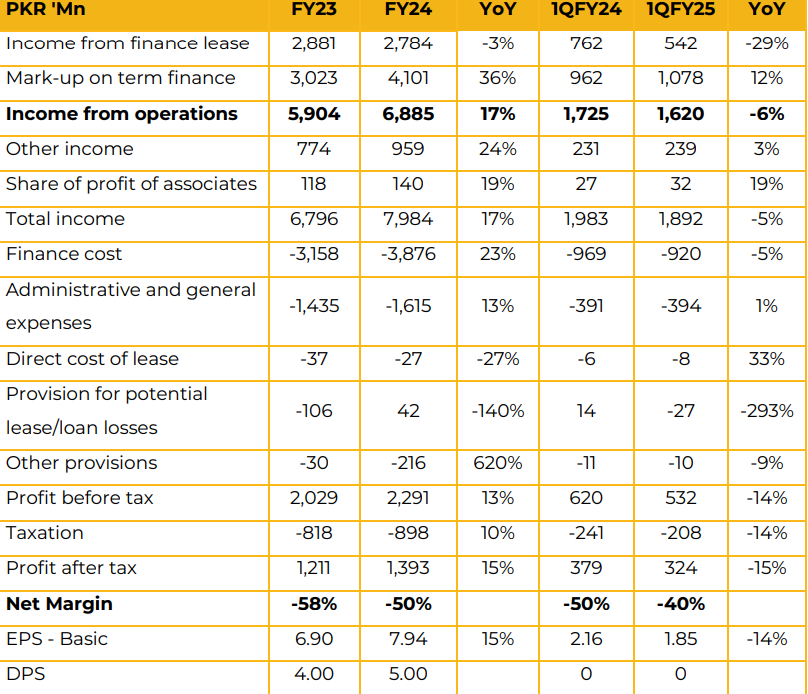

OLP Financial Services Pakistan limited reported Profit per share of PKR 7.94 in FY24 against a profit per share of PKR 6.90 in FY23. Furthermore, in 1QFY25 the company reported profit per share of PKR 1.85 against PKR 2.16 in SPLY.

OLP disbursement of fy2024 includes 70% to SME sector and remaining 30% to individual sector OLP has regular dividends payment history, with a dividend yield ranging between 18-20% over the past few years. The company expects this trend to continue in the coming years. For the FY2024, OLP has disbursed a total of 16 billion, while its portfolio has grown to 25 billion.

This cautious approach reflects the company’s strategy in response to ongoing economic uncertainties. OLP has also highlighted challenges related to workforce management, particularly concerning employee retention, and is actively working on improving these issues. In terms of its legal matters, the sale of OPP Pvt Ltd case is currently under litigation and is in the final stages of resolution.

Going Forward, the company will focus on expanding its SME financing and term finance offerings backed by real estate. In addition, OLP plans to introduce a new product vehicle top-up financing set to launch in the market for the first time. This initiative has already proven successful in Indonesia, where it was pioneered by their parent company, Orix Corporation.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.