Key Takeaways:

• Upward revision in payout ratio expected amid improved liquidity position.

• Recovery ratio improved to 121% (expected: 90%-100%) due to gas price revision under IMF program.

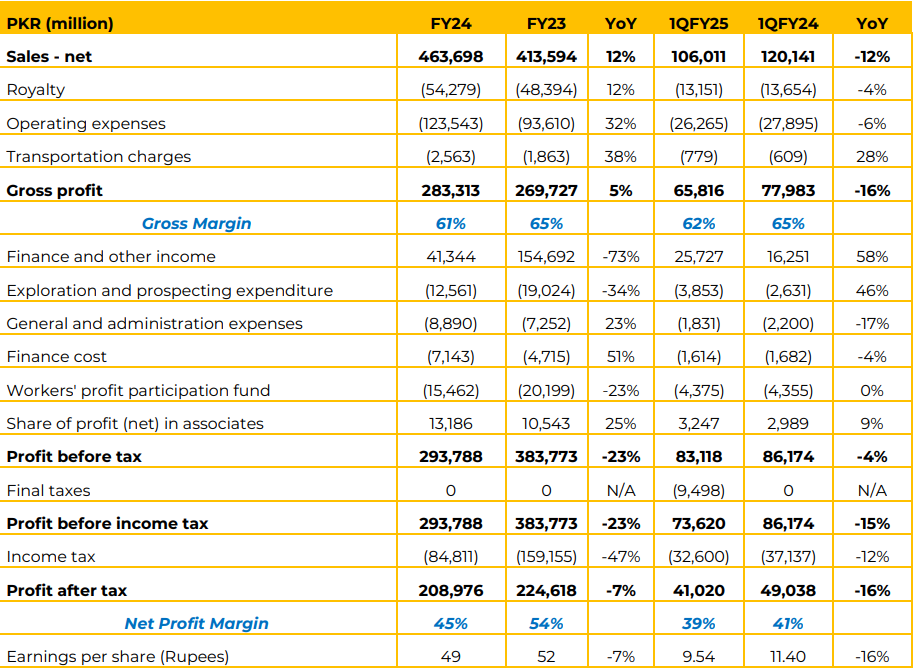

In FY24, OGDC achieved net sales of PKR 463,698 million, reflecting a YoY increase of 12% from FY23’s PKR 413,594 million. However, in 1QFY25, net sales decreased by 12% YoY, amounting to PKR 106,011 million compared to PKR 120,141 million in 1QFY24.

Operating expenses increased significantly by 32% YoY to PKR 123,543 million in FY24, primarily driven by higher costs associated with production activities. For 1QFY25, these expenses slightly decreased by 6% YoY. Royalties for FY24 also increased by 12%, aligning with the growth in sales, while in 1QFY25, royalties decreased by 4% compared to the same quarter last year.

Profit after tax for FY24 amounted to PKR 208,976 million, a 7% decline from the previous year. For 1QFY25, profit after tax was down by 16% YoY to PKR 41,020 million. Earnings per share declined by 7% YoY to PKR 49 in FY24, down from PKR 52 in FY23. For 1QFY25, EPS was recorded at PKR 9.54, reflecting a 16% YoY decrease. The net profit margin also contracted from 54% in FY23 to 45% in FY24, and further to 39% in 1QFY25, indicating a reduction in profitability. OGDC’s recovery ratio has improved to 121% in 1QFY25.

The management expects this ratio to remain in a range of 90%-100% due to gas price adjustments under the IMF program.

The fiscal year concluded on a high note with the recovery of PKR 82 billion, representing OGDCL’s principal investment in PPTFCs issued by the PHPL, bolstering the company’s financial stability. OGDCL has partnered with the Federal Government, Balochistan, GHPL, PPL, and Barrick Gold for the Reko Diq gold and copper project.

The state-owned enterprises hold 25% equity, with Barrick Gold holding 50% and the Government of Balochistan 25%. A special purpose vehicle, PMPL, manages the SOEs’ equity. OGDC has successfully commenced gas production from its Uch-35 development well in Balochistan’s Dera Bugti district.

Drilled to a depth of 1,345 meters targeting the Sui Main Limestone formation, the well is producing 5 million standard cubic feet per day (MMSCFD) of gas. The gas is being supplied to Uch Power Limited after connecting the well to the Uch Gas Processing Plant via a newly laid 1.2-kilometer pipeline. As the sole operator with a 100% stake in the Uch Development & Production Lease, OGDCL aims to enhance national energy security through efficient exploration and production efforts.

The company, in partnership with MARI, is advancing the Shewa asset in the Waziristan block, a high-potential development with estimated reserves of 1.4 TCF. In addition, its own Bettani (Wali) field is projected to produce 3,000 barrels per day of oil and 35 million cubic feet per day of gas, following the successful drilling of the Bettani-2 and Bettani Deep-1 wells. Going forward, the company is actively engaging with the government for the resolution of gas curtailment issue. Moreover, the feasibility of Reko Diq Mining project is expected to be completed by December 2024.

The management indicated some expected upward revision in pay-out ratios, contingent upon the board’s decision and continued improvement in the recovery ratios.

The management also noted that PPRA procurement rules, piled up circular debt, forced gas curtailment by SNGPL and Uch and security situation in Balochistan and Khyber Pakhtunkhwa remains the key challenges for the company. They also mentioned that IMF’s demand for the closure of gas captive plants do not pose any challenge for the company

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.