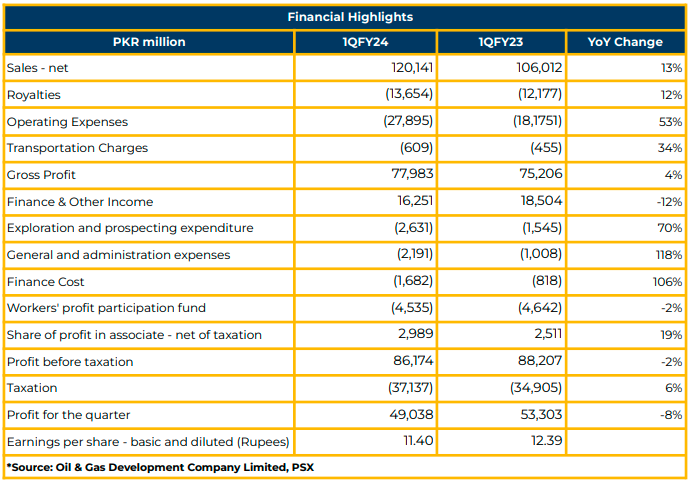

In 1QFY24, Oil & Gas Development Company Limited (OGDC) reported a net income of PKR 49.04 billion (EPS: PKR 11.40), marking an 8% YoY decline from PKR 53.30 billion (EPS: PKR 12.39) in the corresponding period last year.

The company achieved significant revenue growth, reaching PKR 120.14 billion in 1QFY24, a substantial 13% YoY increase from the PKR 106.01 billion reported last year.

Royalties and operating expenses rose by 12% YoY and 53% YoY to PKR 13.65 billion and PKR 27.89 billion, respectively, in 1QFY24. Transportation charges also increased by 34% YoY to PKR 609.20 million during this period.

The company’s finance cost increased by 106% YoY to PKR 1.68 billion in 1QFY24 from PKR 818.23 million in SPLY. Gross profit recorded a 4% YoY increase, reaching PKR 77.98 billion in 1QFY24.

In 1QFY23, OGDC experienced a substantial increase in Exploration and Prospecting Expenditure, reaching PKR 2.63 billion compared to PKR 1.55 billion in SPLY. General and Administrative expenses increased by 118% YoY to PKR 2.20 billion in 1QFY24.

OGDC’s shareholding structure comprises of Government (85.02%), Banks & other financial institutions (5.10%), General Public (4.15%), Foreign

Companies (2.48%), and others (3.24%).

In FY23, OGDC signed multiple MoUs, including geothermal potential evaluation, pursuing green hydrocarbon opportunities, and equity investment in Pakistan Refinery Limited for refinery upgradation. They also executed an MoU with CCDC for a complementary study of shale gas prospectivity in the lower Indus basin.

In June 2023, KPD-TAY simulation study resulted in a recovery enhancement of more than 30%, adding an additional 397 bcf of gas. The company added 80 MMBOE as reserves during the reporting period, resulting in a RRR of 149%.

In FY23, OGDC earned a record profit of PKR 224.6 billion, made three oil and gas discoveries, and achieved a net profit margin increase to 54% compared to 40% in SPLY. Moreover, DGPC provisionally awarded two operated and two non-operated blocks.

OGDC’s exploration portfolio consists of 57 licenses with 22% owned licenses, 26 joint venture licenses, and nine non-joint ventures. The company holds 111 total development & production leases with 34 owned, 43 operated joint ventures, and 34 non-joint ventures.

Although the net production of oil significantly reduced in the last five years to 32,478 barrels per day in FY23 against 40,810 barrels per day in FY19, the company successfully maintained a market share at 46%. The natural average decline rate of five years stands at 18% per year, but the management arrested the decline to 6-8% through workovers, development wells, and artificial lift systems.

Similarly, the production of net gas declined to 764 mmscfd per day in FY23 against 1,014 mmscfd per day in FY19 while maintaining the market share at 29%. The company controlled the decline rate around 5% YoY by optimizing operations against the natural average decline rate of 10%.

The net LPG production reduced to 720MT per day in FY23 from 802MT per day in FY19. The market share of the company increased from 34% in FY19 to 36% in FY23. OGDC controls 42% of the total oil reserves and 36% gas reserves of the country. Management shared that the Nashpa oilfield is depleting at 11,000 barrels per day (16-18%). Nashpa field provides one-third of the production of OGDCL. The Company is trying to arrest the depletion.

Province-wise breakup of concessions is as follows: KPK (12%), Sindh (15%), Punjab (23%), and Balochistan (50%). The market shares of OGDC in 2D and 3D seismic are 55% and 39%, respectively. The market share of the Company is 21%. The success ratio of the Company in wells is 1:2.65 against the industry success ratio of 1:2.8. Furthermore, OGDC successfully completed the installation of Early Production Facilities (EPF) to fast

track monetization of hydrocarbons at Wali1 (Bettani field).

OGDC management is striving to maintain and accelerate exploration activities to tap additional reserves and optimize hydrocarbon production.

About dividends, the management shared that receivables form Sui companies are likely to improve payout ratio of the Comapny. From Sui companies, the management reported that the receivables have been recovered by 86%. The oil receivables are 100% as per management.

The increase in gas prices is likely to resolve the circular debt problem of the Company. The management is going to negotiate with Sui Companies regarding the gas price and anticipates positive results in 1QCY24.

After the increase in gas prices, the Company plans to revive the dormant project. The Jhalmagsi project is one of them, and the Company is likely to start the monetization of this project.

Regarding the discovery of alternative energy sources, the management shares that the long-term planning of the company includes the diversification of the portfolio through joint ventures. Also, the total demand will still be higher despite the availability of alternatives.

Regarding CSR, the Company completed 52% educational projects, 17% health, 15% water, 6% infrastructure, and 6% disaster-related projects.

Going forward, the management plans to focus on high-impact projects rather than increasing the number of wells while keeping operating expenses under control.

The consortium arrangement (300,000 bpd) under a MoU between OGDCL and PSO is likely to be financed with minimum equity. The Capex for this greenfield refinery project in Balochistan is nearly PKR 12 billion, as per management.

The additional capex PKR 150 million on Uch and KPD fields is anticipated to occur in the next financial year. Moreover, the Company plans to add 2000-10000 barrels per day of oil in the next five years. The Wali (Bettani) well is likely to come online from June 2024, and in the next six months, the production will commence. The feasibility of the Rekodiq project will be completed by the end of 2024.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.