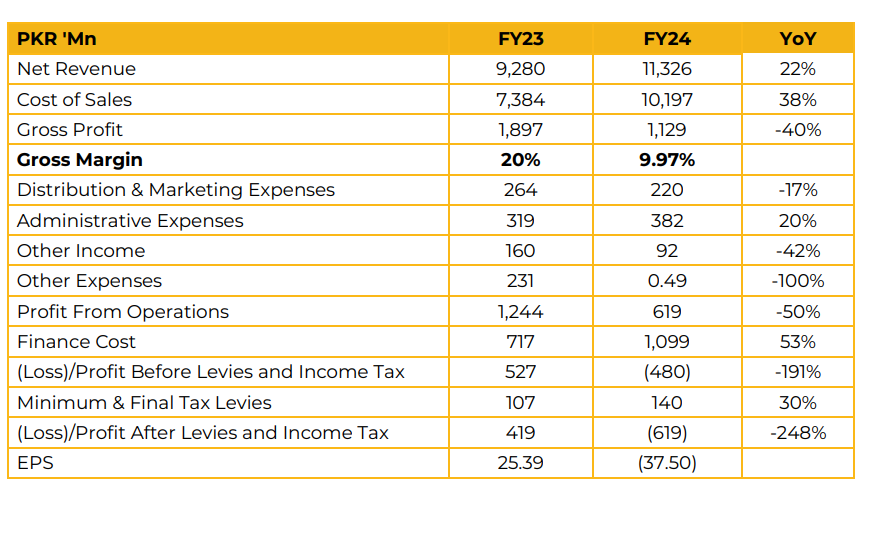

In FY24, Noon Sugar Mills Limited (NONS) reported a net loss of PKR 619.45 million (LPS: PKR 37.50), a significant decline from the net profit of PKR 419.31 million (EPS: PKR 25.39) recorded in FY23. The loss was attributed to a higher sugarcane price of PKR 470 per maund and volatility in the USD-PKR exchange rate, as molasses was procured at elevated rates before the exchange rate reversed, compounding the losses. The company crushed 712,164 M.Tons of sugarcane in FY24, compared to 807,367 M.Tons in FY23.

Despite the reduction, NONS achieved its highest-ever average sucrose recovery of 10.30%, ranking second or third in Punjab for FY24. Sugar production stood at 73,597 M.Tons, slightly lower than the 75,717 M.Tons produced in FY23. Alcohol production also declined to 13,429 M.Tons in FY24 from 18,334 M.Tons in FY23.

Total assets increased significantly to PKR 9.08 billion in FY24, up from PKR 6.17 billion in FY23, primarily due to major capital expenditures, including the acquisition of a 100 M.Tons boiler from HMC and a 10MW turbine. The management anticipates improved fuel and cost efficiency regarding bagasse usage. The current sugarcane rate in Punjab varies between PKR 415-460 per maund, depending on the region and variety.

The industry plans to implement a pricing mechanism aligned with sucrose recovery, which management expects to materialize in the next 2-3 years. Molasses prices are currently PKR 26,000-29,000 per M.Ton, while ethanol prices range between PKR 710-740 per M.Ton, depending on shipment timing. However, international demand for ethanol remains subdued, exerting downward pressure on prices. Management highlighted that the ex-factory sugar price is approximately 20% less than the MRP, which is currently PKR 140 per kg. Holding costs are primarily impacted by financial costs, as maintenance and insurance costs per kg remain minimal.

Financial costs have already been reduced, with further reductions expected. Exports are contingent upon total sugar production, with the sugar advisory board allocating quotas based on surplus sugar production and approval from the ECC.

Management expects reported sugarcane area to increase by 8-10% compared to last year, though yields are estimated to be 15% lower. Initial estimates suggest sugar production may decline by 3-4% YoY, with a clearer picture to emerge by midFebruary 2025. The crushing season is expected to continue until March 10, 2025. Looking ahead, management anticipates recovering last year’s losses due to lower sugarcane procurement prices around PKR 425 per maund and improved sugar sale prices. The current crushing season is expected to be profitable, with the distillery segment also projected to perform well, supported by a stable exchange rate.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.