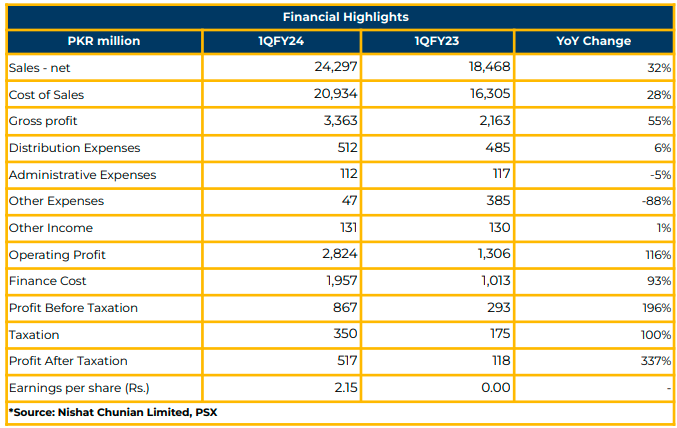

In 1QFY24, Nishat Chunian Limited demonstrated remarkable growth, achieving a net profit of PKR 516.89 million (EPS: PKR 2.15), reflecting a robust increase of 337% YoY from PKR 118.28 million (EPS: PKR 0.00) in the corresponding period of the previous year.

The Company’s revenue experienced a notable surge, reaching PKR 24.30 billion in 1QFY24, indicating substantial 32% YoY growth from the PKR 18.47 billion reported in the same period last year. However, the reduction in spinning’s sales revenue negatively impacted the margins of the Company.

The primary revenue contributions came from the Spinning (61%), Weaving (13%), and Processing & Home Textile (26%) segments in FY23, with the local business contributing 59% and exports 41%.

In the spinning division, yarn exports witnessed a decrease of 16% YoY (PKR 9.2 billion) in FY23, compared to the 4% increase (PKR 10.9 billion) in the previous year. On the other hand, local yarn sales registered an increase of 23% YoY to PKR 32.3 billion. The Company observed overall growth in total yarn sales by 12% YoY (PKR 41.5 billion) in FY23.

Total weaving sales grew by 15% YoY to PKR 8.59 billion, with increased exports (31% YoY) in FY23. Similarly, home textiles witnessed revenue growth of 3% to PKR 17.50 billion (compared to PKR 17.05 in FY22) in FY23, with exports increasing by 92% YoY.

Cost of sales increased by 28% YoY to PKR 20.93 billion in 1QFY24 from PKR 16.31 billion in the prior year. In contrast, administrative expenses decreased by 5% YoY to PKR 111.53 million in 1QFY24, while distribution expenses increased by 6% YoY to PKR 512.39 million in 1QFY24 from PKR 484.61 million in SPLY.

The finance cost of the Company increased by 93% YoY to PKR 1.96 billion in 1QFY24 from PKR 1.01 billion in SPLY. Both gross profit and operating profit recorded substantial increases of 55% YoY and 116% YoY, reaching PKR 3.36 billion and 2.82 billion, respectively, in 1QFY24.

The capacities in different divisions are as follows: Spinning (86 million KGs of yarn/year), Weaving (345.6 million square meters of fabric/year), Dyeing & Printing (63.12 million meters of fabric/year), and Stitching (depends on the length of order lots).

The capacity utilization of spinning, weaving, and dyeing & printing divisions was reported at 98.52%, 89%, and 55%, respectively, in FY23.

Moreover, NCL operates 223,428 spindles, 2,880 rotors in the spinning segment, while 379 looms in the weaving segment. In the dyeing & printing segment, Nishat Chunian operates one thermosol machine, five stenter machines, one rotary printing machine, and five digital printing machines.

NCL relies on coal (80-90%) and uses a mix of local and imported coal, making the recent increase in gas prices unlikely to impact the Company’s cost. Zone III of home textile is dependent on solar power.

The Company consumes 70% local cotton and 30% imported cotton. One-third of the borrowing of the Company is SBP-funded subsidized loans, and the remaining are commercial loans. Management shared that the reduction in input costs can give the textile industry a competitive edge in the world market.

Going forward, the management plans to enhance the capacity of the Auto Core unit in the spinning segment and expand the number of outlets. Moreover, the installation of new ring winders and contamination sorting machines in the spinning division and the installment of a new sizing machine in the weaving division are also on the cards. Plus, the addition of E-Commerce or online business is also part of this enhancement.

Furthermore, NCL aims to start trading products from the recently launched showroom in New York while introducing new product ranges at the same time. The target revenue of the Company is PKR 100 billion in the next year. Management expects thin margins for spinning this year unless the price improves.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.