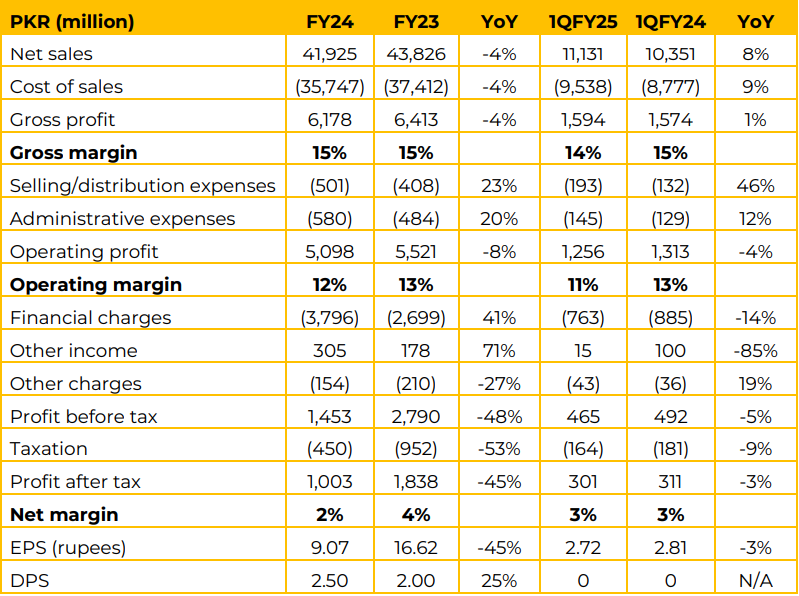

Net sales for FY24 declined by 4% YoY, totaling PKR 41.93 billion, down from PKR 43.83 billion in FY23. The decline was offset to some extent by an 8% increase in 1QFY25 sales, which amounted to PKR 11.13 billion, compared to PKR 10.35 billion in 1QFY24. . Gross margin remained stable at 15% for both FY24 and FY23.

Gross margin in 1QFY25 declined slightly to 14%. Financial charges surged by 41% YoY to PKR 3.80 billion in FY24. The company experienced a decrease in financial charges in 1QFY25 (down 14% YoY). Earnings per share (EPS) for FY24 fell by 45% YoY to PKR 9, compared to PKR 17 in FY23. In 1QFY25, EPS remained PKR 2.72, showing a marginal 3% drop.

The company has recently acquired a soap manufacturing facility in Hub, Balochistan from P&G with a production capacity of 20,000 M. Tons per year. The products will be sold to P&G. This development solidifies the company’s presence in the South region, also enabling increased exports through the seaport.

The management noted that total power capacity for Sheikhupura plant is 17 MW, out of which 5 MW is catered from WAPDA. At Hub plant, the power capacity is 2 MW. Going forward, the company expects positive impact of interest rate decline on their profitability. The management also anticipates some improvement in the gross margins and overall consumer demand.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose