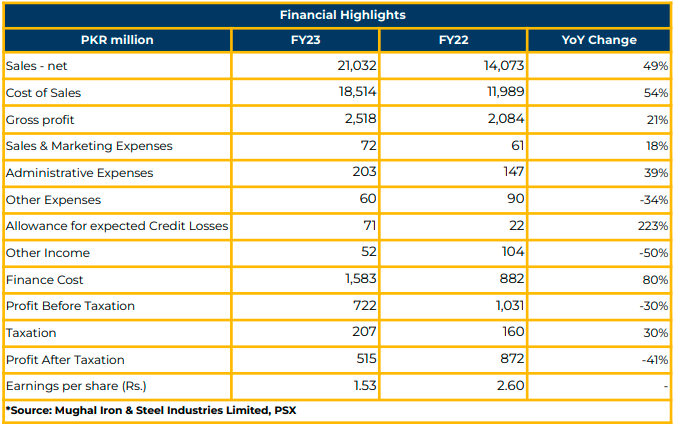

In FY23, Mughal Iron & Steel Industries Limited achieved a net profit of PKR 515.06 million (EPS: PKR 1.53), indicating a decrease of 41% YoY from PKR 871.52 million (EPS: PKR 2.60) in the corresponding period of the previous year.

The Company’s revenue experienced a notable surge, reaching PKR 21.03 billion in FY23, indicating substantial 49% YoY growth from the PKR 14.07 billion reported in the same period last year.

Cost of sales increased by 54% YoY to PKR 18.51 billion in 1QFY24 from PKR 11.99 billion in the prior year. In contrast, sales & marketing expenses and administrative expenses increased by 18% YoY and 39% YoY to PKR 71.96 million and PKR 203.48 million, respectively, in 1QFY24.

Other income and other expenses declined by 50% YoY and 34% YoY to PKR 51.93 million and PKR 59.81 million, respectively, in 1QFY24.

The finance cost of the Company increased by 80% YoY to PKR 1.58 billion in 1QFY24 from PKR 881.61 million in SPLY. Gross profit recorded substantial increases of 21% YoY, reaching PKR 2.52 billion in 1QFY24.

The cost breakdown of the Company is as follows: 20% duties, 50% scrap, 20% Energy, 10% financial cost.

In FY23, MUGHAL witnessed a sales revenue of PKR 67.39 billion, compared to PKR 66.15 billion the previous year. The increase in sales revenue was attributed to price increases.

Sales volumes of the ferrous segment witnessed a decline while those of the non-ferrous increased in FY23. The profitability of the Company reached PKR 3.48 billion (EPS: PKR 10.37) in FY23, compared to PKR 5.41 billion (EPS: PKR 16.12) in FY22.

Pre-tax profit of the Company increased by % YoY to PKR 4.35 billion in FY23, compared to PKR 6,20 billion in the same period last year

Moreover, the steel Company successfully completed a recycling plant. In addition, in-house consumption of iron scrap was generated from the non-ferrous segment. Diversification of the product portfolio in the form of copper granule was achieved. Moreover, the Company eliminated the conversion cost of melting copper ingots.

The part of the copper expansion, after having started operations this year, is due to be completed by February 2024.

The cost for graded steel bars was quoted at PKR 275,000, while that for ungraded steel bars was PKR 250,000.

In FY23, the net margins of the Company significantly reduced to 5.16%, compared to 8.18% in FY22 due to the unavailability of raw material resulting from supply chain disruptions and LCs issues in the country. GP Margins, however, slightly declined to 14.35% in FY23 vs. 15.31% in FY22. Likewise, ROE was reported at 13.72% in FY23, compared to 25.96% in FY22.

Management shared that the implementation of axle load management is not likely to impact the company because it has its own railway network with two railway stations.

The company is currently utilizing 35% of its capacity. However, the Company expects the margins to improve if the capacity utilization improves depending on the availability of raw material and a smooth supply chain.

Due to the increase in gas prices, the company is not currently utilizing it. Instead, the Company utilizes a mix of coal and biomass fuels to save energy costs. On the other hand, management informed that shares of Mughal Energy Limited have been acquired and commissioning of the Coal Captive Power Plant (36.5MW) has started, and it is expected to achieve COD within 14-16 weeks.

Going forward, the management plans to focus on increased export volumes in the non-ferrous segment while maintaining volumes in the ferrous segment. Bringing the power plant online is also the way forward. However, the financials of the Company are likely to be impacted by finance costs and overall economic slowdown in the country.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.