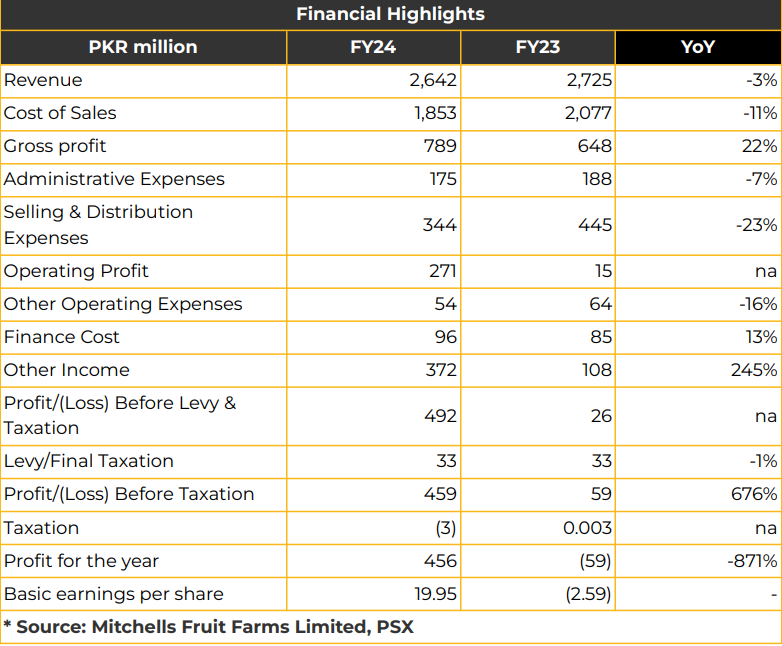

In FY24, Mitchells Fruit Farms Limited (MFFL) reported a net profit of PKR 456.24 million (EPS: PKR 19.95), a significant improvement from the net loss of PKR 59.20 million (LPS: PKR 2.59) in the previous year’s corresponding period. Despite a 3% YoY decline in net revenue to PKR 2.64 billion, gross profit rose by 22% YoY, reaching PKR 789.17 million, up from PKR 648.12 million in the SPLY.

The gross profit margin saw a notable increase, climbing to 29.87% from 23.78%, as the company’s cost-control measures and price rationalization boosted profitability despite a slight turnover decline. Management reported effective cost-control efforts, reducing Selling & Distribution Expenses and Administrative Expenses by 23% and 7%, respectively. This facilitated a robust turnaround in operating profit, which surged to PKR 270.53 million from PKR 15.44 million in the previous year.

Management noted that operating profit included gains from the sale of fixed assets, contributing to cash flow improvements through cost reductions and sales continuity.

The cost of sales decreased 11% YoY, amounting to PKR 1.85 billion, compared to PKR 2.08 billion in the previous period. Finance costs, however, rose by 13% YoY to PKR 96.19 million due to elevated KIBOR rates, while other income showed a significant increase, reaching PKR 371.67 million.

Management also reported that export margins, including for sauces, are higher than those of domestic sales. However, marketing expenses were constrained by cash flow limitations.

Going forward, MFFL plans to emphasize product efficiencies, quality improvements, and operational enhancements over volumetric growth.

The company aims to increase exports, boost B2B sales through its excess pulping capacity, and relaunch products with improved formulations.

Additionally, MFFL intends to prioritize high-margin secondary categories and expand customer outreach

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time

to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a

position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this

report Chase Securities as a firm may have business relationships, including investment banking

relationships with the companies referred to in this report This report is provided only for the information

of professional advisers who are expected to make their own investment decisions without undue reliance

on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted

that investments in capital markets are also subject to market risks This report may not be reproduced,

distributed or published by any recipient for any purpose.