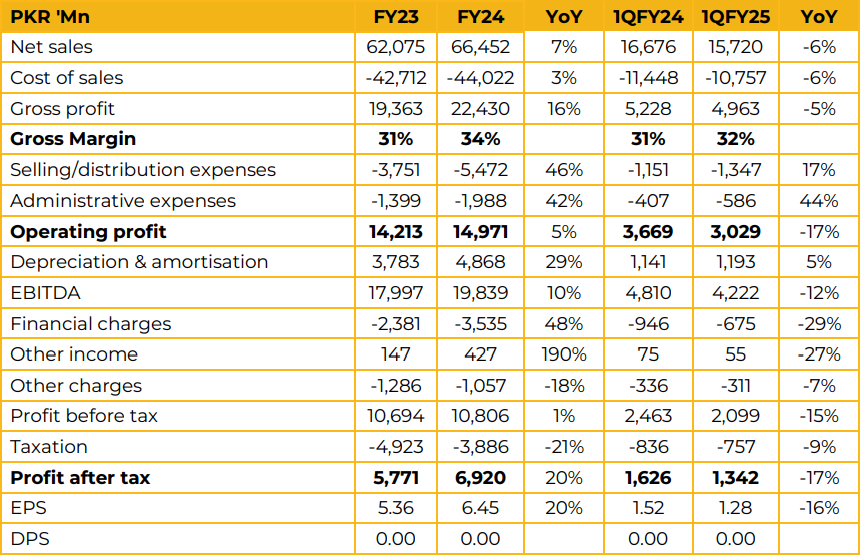

Maple Leaf Cement Limited reported earnings per share of PKR 6.45 in FY24 against PKR 5.36 in FY23, an increase of 20%. Total revenue in FY24 reached PKR 66.5 Bn against PKR 62.1 Bn in FY23, an increase of 7%.

Gross margin was recorded at 34% in FY24 up from 31% in FY23. The company generates its power from multiple sources including coal power plant, waste heat recovery, solar and biomass (canola and sesame husk).

In FY24 this led to power cost being about PKR 19 per unit or 7 cents per Kwh.

In FY24 the company’s fuel cost mix was as follows:

Local coal: 22% (37,000 per ton)

Imported coal: 61% (42,000 per ton)

Biomass: 17% (18,500 per ton)

Overall: 39,000 per ton

Going forward the company hopes to follow a fuel mix of 29% biomass and 71% pet coke which at current rates creates an average cost of PKR 35,000 per ton.

The management highlighted that they hope to continue to move towards biomass as a source of fuel as it is much cheaper.

As such, it aims to bring usage of this fuel to 40% of usage. It was also pointed out that due to ban on sulphur based fuels in China imported coal was becoming cheaper to use than local coal due to its higher Gross Calorific Value of 7,500- 8000 per kg compared to 6,200 per kg of locally sourced coal.

Management was hopeful of its putty project yielding more profitability going forward due to its higher margins of PKR 60,000 per ton against PKR 16,000 per ton of white cement. It pointed out that this was a smaller market right now but they see great potential in the future. In FY24 this market was about 10,500 tons and the company has set a target for 13,000 tons for FY25.

It was also clarified that the company’s distribution cost was double that of the industry at 8% of net sales due to them operating in a delivered sales model hence the freight cost is included under the distribution costs head.

The current retention price is 17,500 per ton. Regarding the royalty levied on extraction of limestone the management revealed that despite a rise they are paying 50% while submitting bank guarantee for the other 50%. Regarding investments in other ventures the management spoke about Novacare hospitals and how is it being developed in affiliation with Imperial College London.

They believe that this will be a super-premium facility. MLCF will hold a 67% stake in the hospital project with 50% of it being financed through equity and 50% through debt. The total outlay for this project is PKR 30 Bn and it is expected to be commissioned in September 2026.

The project contract has been awarded and construction is ongoing. With regard to its announcement of intention to buy shares of Agritech Limited the management highlighted that they believe the company has significant potential. They plan to use the cement sector supply chain to distribute AGL’s products in the country. Going forward the management said that they expect a consolidated gross margin of 33% for FY25. Additionally, it was made clear that as opposed to a regular dividend policy the company believes that better returns can be made through investments in acquisitions.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.