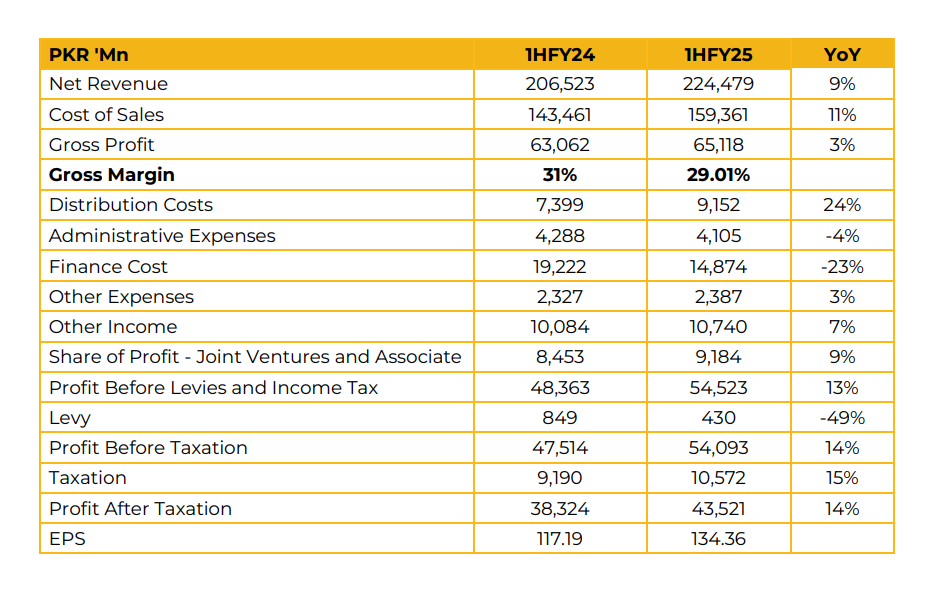

In 1HFY25, Lucky Cement Limited (LUCK) reported a net profit of PKR 43.52 billion (EPS: PKR 134.36), reflecting a 14% YoY increase from PKR 38.32 billion (EPS: PKR 117.19) in the SPLY. The profitability growth was attributed to higher export volumes and cost efficiencies. Volumetric dispatches increased by 8.7% YoY in 1HFY25, primarily driven by export growth, while domestic demand declined by 14% YoY to 3MT, exerting pressure on prices.

As a result, LUCK’s market share declined to 16.4% from 17.1% in the SPLY. Export volumes surged by 92.3% YoY to 1.8MT, supported by improved global demand and expanded production capacity, raising LUCK’s export market share to 37.6% from 25.7% in the SPLY.

The key export destinations are Africa, Sri Lanka and Bangladesh. The company announced a 5:1 stock split to attract retail investors and improve liquidity. LUCK also completed the commissioning of a 28.8MW captive wind power project at a cost of PKR 9 billion, increasing the share of renewable energy in its total energy mix to 55%. In December 2024, the northern plant operated at 42% renewable capacity while southern plant at 56% renewable capacity.

EBITDA declined due to margin pressures from lower cement prices. Local average retention prices stood at PKR 16,000 per ton, while export retention for Afghanistan was PKR 9,000 per ton. Coal costs decreased from PKR 37,000 per ton in 1QFY25 to PKR 35,000 per ton in 2QFY25. The company’s southern plants use imported coal, whereas the northern plants rely on a mix of local and Afghan coal.

Cement is priced at $41 per ton, compared to clinker at $30 per ton. Foreign operations remained strong, contributing PKR 9 billion to profitability. LEPCL continued to operate at full capacity. Clinker production capacity expansion in Iraq is expected to be completed in 2HFY25, with the Iraq and Congo plants currently operating at 90-95% capacity Other income in standalone results primarily came from mutual fund and dividend income, including PKR 1.7 billion from LMC and PKR 1.4 billion from LCI. Consolidated other income was driven by bank cash surpluses.

Looking ahead, management expects domestic cement demand to remain subdued in 2HFY25 due to Ramadan and Eid holidays. Cement prices are anticipated to improve in north. The chemical segment’s performance is anticipated to align with overall economic growth.

Despite declining cement prices, margins are expected to remain in the highest percentile, supported by LUCK’s lowest coal cost per ton and the highest renewable energy consumption in the industry. Management is also evaluating various strategic projects for diversification, leveraging its cash surplus.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.