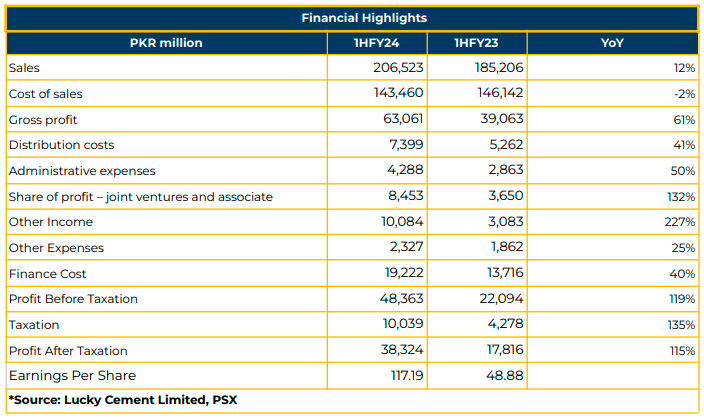

In 1HFY24, Lucky Cement Limited (LUCK) reported a net profit of PKR 38.32 billion (EPS: PKR 117.19), marking a significant 115% YoY increase from PKR 17.82 billion (EPS: PKR 48.88) in the corresponding period last year (SPLY).

The company’s net sales saw a 12% YoY increase to PKR 206.52 billion in 1HFY24, compared to PKR 185.21 billion in the corresponding period of the previous year. This rise was mainly attributed to increased domestic sales and higher revenue from Lucky Electric Power Company Limited and Lucky Core Industries Limited.

Gross profit increased by 61% YoY to PKR 63.06 billion in 1HFY24, compared to PKR 39.06 billion in the previous year.

LUCK’s cement dispatches in 1HFY24 reached 4.41 million tons, showing a 23% YoY increase, primarily due to a new line in Pezu. Export dispatches increased by 59% in 1HFY24 compared to SPLY, while local dispatches saw a 16% increase.

Cost of sales decreased by 2% YoY to PKR 143.46 billion during the said period. Distribution cost and administrative expenses increased by 41% and 51% to PKR 7.34 billion and PKR 4.29 billion, respectively in 1HFY24.

In 1HFY24, LUCK’s financing costs increased by 40% YoY to PKR 19.22 billion compared to PKR 13.72 billion in SPLY, primarily due to high-interest rates.

Management reported the termination of the share purchase agreement with Lucky Core Ventures (Private) Limited (LCV) due to unmet conditions within the stipulated time frame.

Lucky Cement Company holds three months’ receivables. The remaining tariff true up of Lucky Electric Power Company Limited (LEPCL) is expected in 2HFY24.

The South plant relies entirely on imported coal, while the North plant uses local coal. The cost of local and imported coal is $105 and PKR 43,000, respectively, which becomes equivalent when transportation cost is added. The freight cost is approximately ~PKR 6,000-PKR 7,000 from Karachi port to the North plant.

As per management, LUCK is not utilizing Thar coal due to its infeasibility for its existing plants.

Regarding an investment of up to PKR 1 billion in its associated company, National Resources (Private) Limited (NRL), Company has already invested PKR 475 million and expects to invest PKR 500 million in the next 12-18 months.

After the completion of solar and wind power projects, the renewable contribution will account for 50% of the total energy requirements for LUCK. The 28.8 MW wind power project is likely to be completed by Aug 2024. The total cost of renewable projects is estimated at PKR 10 billion.

Regarding a new clinker line of 1.8 million MTs in Samawah, Iraq, the management indicated that the project is expected to become operational in FY25. The construction period is anticipated to be 18 months, and profit margins are expected to improve.

Going forward, LUCK anticipates the current demand pattern to continue in 2HFY24. Additionally, the dividend policy is contingent on current cash flow generation, contingencies, and long-term investment.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.